If you Google “Product Bundling on Amazon,” near the top of the first page, there is a tray of 10 videos explaining how to use Fulfillment by Amazon (“FBA”) to design and sell bundles to online retail customers. Selling products together in a single package is clearly a hot topic in B2C ecommerce. When you google “B2B Product Bundling,” videos and user guides are nowhere to be found.

Yet we hear routinely from B2B product managers and pricing professionals that designing and pricing packaged systems and solutions is near the top of their priority list.

Yet we hear routinely from B2B product managers and pricing professionals that designing and pricing packaged systems and solutions is near the top of their priority list.

Economists and business strategists often use the word “bundle” to refer to a combination of products and services in an offer. As a matter of practice, careful business professionals and their lawyers increasingly stay away from the word “bundle,” to avoid association with Microsoft (browser wars) and other antitrust actions. As a result, the “b-word” is politically incorrect in many practitioner circles. Nevertheless, these same practitioners frequently seek better packaged offerings of products and services, as they design B2B go-to-market strategies. For the most part, in this blog series, we will steer clear of the “b-word”, and stick to more broadly acceptable terms such as “packaged systems” and “packaged solutions.”

3 Reasons that Packaged Systems & Solutions are Trending in B2B. As we enter the next decade, the importance of designing offers that combine products and services is not hard to appreciate. There are three factors driving the increase in time and energy that is, and should be, spent on designing and pricing B2B systems and solutions:

1. The Challenge of Selling More Complex Offerings to Ever-Larger Buyer Committees. Technology may be expanding the scope of the possible, but it isn’t making products or services any simpler. An Engineering.com report found that 92% of design and engineering professionals surveyed reported that their products had increased in complexity over the last five years. With greater automation, access to vast quantities of data and tools to speed up design, innovation is driving product proliferation at speeds that are occasionally too fast. The increasing complexity of products and offerings is apparent.

1. The Challenge of Selling More Complex Offerings to Ever-Larger Buyer Committees. Technology may be expanding the scope of the possible, but it isn’t making products or services any simpler. An Engineering.com report found that 92% of design and engineering professionals surveyed reported that their products had increased in complexity over the last five years. With greater automation, access to vast quantities of data and tools to speed up design, innovation is driving product proliferation at speeds that are occasionally too fast. The increasing complexity of products and offerings is apparent.

This complexity is arriving at the same time that the buying audience involved in any decision is also increasing. B2B buying decisions are invariably a committee process based on building consensus among a number of individual stakeholders. In 2016, according to Brent Adamson, the average number of stakeholders involved in a B2B purchasing decision had risen to 6.8. As the knowledge base and backgrounds of buying committees becomes increasingly diverse, presenting technical details and product specifications is less and less likely to connect with many buyer stakeholders. Instead, communicating outcomes, results, and financial value is a better way to speak in a language that all buyer stakeholders will understand and care about.

This complexity is arriving at the same time that the buying audience involved in any decision is also increasing. B2B buying decisions are invariably a committee process based on building consensus among a number of individual stakeholders. In 2016, according to Brent Adamson, the average number of stakeholders involved in a B2B purchasing decision had risen to 6.8. As the knowledge base and backgrounds of buying committees becomes increasingly diverse, presenting technical details and product specifications is less and less likely to connect with many buyer stakeholders. Instead, communicating outcomes, results, and financial value is a better way to speak in a language that all buyer stakeholders will understand and care about.

Reducing the number of choices a buying committee needs to make to a few recommended packages simplifies the committee process if those alternatives are well chosen. Well-designed good-better-best offerings, recently reviewed by Rafi Mohammed, are as important in B2B as they are in B2C.

2. The Increasing Importance of Services in Go-to-Market Strategies. A recent McKinsey Global Institute Report highlights the increasing prominence of services in domestic economies and in international trade. Globally, services account for almost two-thirds of GDP and half of all jobs. In advanced economies like the United States, services can account for around 80 percent of GDP and private-sector employment.

Over the past decade, international trade in services has grown 60% faster than trade in goods. McKinsey argues that 2017 international trade statistics, showing that trade in goods ($17.3 trillion) still overshadows trade in services ($5.1 trillion), understate the relative importance of services. They highlight the increasing share of value that services add to exported goods, the intracompany exchange of intangibles across borders, and free digital services made available to global users. Correcting for these effects, McKinsey concludes that, in value-added terms, international trade in services already exceeds international trade in goods.

Over the past decade, international trade in services has grown 60% faster than trade in goods. McKinsey argues that 2017 international trade statistics, showing that trade in goods ($17.3 trillion) still overshadows trade in services ($5.1 trillion), understate the relative importance of services. They highlight the increasing share of value that services add to exported goods, the intracompany exchange of intangibles across borders, and free digital services made available to global users. Correcting for these effects, McKinsey concludes that, in value-added terms, international trade in services already exceeds international trade in goods.

In many industries, the rise of services and the integration of services with products are front and center. Licensed, installed software is rapidly converting to SaaS (software-as-a-service), PaaS (platform-as-a-service), and IaaS (Infrastructure-as-a-Service). Products we used to sell as Things are now packaged with technology, software and services to become the Internet of Things. Services are increasingly important in the sale of software, disposables, instruments, and equipment – services make durable goods more durable and customers more successful. Software and technology have become essential to embed the best practices prescribed by consultants and trainers. Services support recurring revenues from products sold. Products support sustainable success from services delivered.

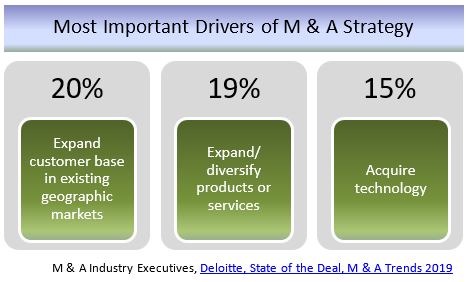

3. The Focus on Optimizing Product Portfolios Following Mergers & Acquisitions. M & A is nothing new, but it is increasingly important in product strategy. Survey respondents for the Deloitte 2019 M & A Trends report expect acceleration in the number and the dollar value of deals. M & A executives site the top three reasons for corporate M & A are: (1) to expand their customer base, (2) expand/ diversify products or services, and (3) acquire technology. All three of these reasons suggest that a post-merger organization will be seeking to sell and deliver diverse products and services together.

With M & A comes the temptation to reduce post-merger costs by jamming products and/or services together into a sales rep’s bag, by managing production and inventory together and by commingling the two organizations’ service offerings. When combined products and services are managed and/or delivered as an amalgamation of disconnected items, chaos generally ensues. A deliberate portfolio management strategy is essential to extract strategic returns from a combination of products and services.

We see the results in a number of industries. Human health products and crop health products are being pooled, where the combined organization’s understanding of patient therapies or plant treatments increasingly provides data and experience uniquely available to the seller. The resulting innovative services in healthcare or agriculture, often specific to the seller’s products, improve patient outcomes or agricultural performance, providing the basis for new go-to-market strategies. Software, instrument, equipment, disposable, and service offerings are being pooled in M & A in ways that make it possible to provide packages that optimize a customer’s entire workflow. This opens up the opportunity to provide end-to-end solutions that continue to drive innovation in products and services.

As these packaged solutions emerge in post-merger organizations, deliberate packaging strategies are often a required response by their competitors. Smart competitors anticipate packaging when a merger is announced and start to design their own packaged offerings immediately while their recently merged rival is distracted by post-merger integration.

In sum, these three factors, separately and together, focus organizations on product portfolio management, making great design of product and service offerings a strategic imperative.

Great Offer Design. The basic tools for offer design in B2B start with the tools used by restaurants. A local diner may offer most or all of its menu items a la carte, but innovative chefs often come up with one or more prix fixe meals that invite patrons to try innovative preparations and avoid agonizing over their choice of dishes for each course. Some restaurants primarily offer prix fixe selections even though they know they need to adapt to specific tastes and dietary requirements. Others display a mix of a la carte and prix fixe selections. A restaurant’s strategy in designing the menu is both about the dishes it provides and about choosing good combinations for its prix fixe offerings. A good restaurant manager focuses on how customers evaluate their dining experience and how customers perceive the average price of a meal on a consistent and recurring basis.

Great Offer Design. The basic tools for offer design in B2B start with the tools used by restaurants. A local diner may offer most or all of its menu items a la carte, but innovative chefs often come up with one or more prix fixe meals that invite patrons to try innovative preparations and avoid agonizing over their choice of dishes for each course. Some restaurants primarily offer prix fixe selections even though they know they need to adapt to specific tastes and dietary requirements. Others display a mix of a la carte and prix fixe selections. A restaurant’s strategy in designing the menu is both about the dishes it provides and about choosing good combinations for its prix fixe offerings. A good restaurant manager focuses on how customers evaluate their dining experience and how customers perceive the average price of a meal on a consistent and recurring basis.

In contrast to B2C, B2B commercial organizations address customers who are measured by their financial results. Their customer stakeholders are often required to evaluate where their spending gets the best returns and to defend how they spend money in budgeting and procurement processes. Consequently, additional tools are essential in designing great B2B offering menus. In this blog series we will explore the legitimate reasons for packaging, contrasting packages with their associated a la carte offerings. Although these reasons are not mutually exclusive, they sometimes have different implications for pricing, marketing and menu design. As we consider offering and pricing strategies, we will highlight useful processes and tools in designing offers, using specific illustrative examples as we do so.

3 Approaches that Result in B2B Packaging Failures.Before considering the good reasons for packaged offerings, it is worthwhile highlighting three attitudes we observe that frequently impair the implementation of successful solution design and selling.

3 Approaches that Result in B2B Packaging Failures.Before considering the good reasons for packaged offerings, it is worthwhile highlighting three attitudes we observe that frequently impair the implementation of successful solution design and selling.

1. “Just cram our products and services into a shopping cart.” There is a widespread misperception that solution selling is about giving sales reps a tool for taking multiproduct orders. If there are differentiating benefits to highlight to the buyer in a presentation, just make the list of these benefits longer to reflect the various products chosen from the menu. If there is differential financial value of our products versus the alternatives, just add it up. This attitude pays more attention to how the waiter takes orders for the meal and presents the bill. It pays less attention to which prix fixe offerings will keep diners returning to the restaurant.

While sometimes justifying a significant reduction in force (RIF) of sales headcount, this approach is unlikely to increase revenues or profitability. The clarity of a good value proposition for one product, with 2 or 3 strong reasons to buy, is diluted when there are 5 products with 10-15 reasons to buy. Sales professionals become irrelevant if their role is to act as a substitute for a digital shopping cart. Jamming products and services together without considering customer segments, buyer problems, and alternative solutions will never drive value selling. Sales professionals are unlikely to become trusted advisors. Buyers will probably become unreceptive to sales conversations.

2. “Bundles are a way to take advantage of buyers.” In a Harvard Business Review article in 2010, Anthony K. Tjian takes the position that “…unbundling or a la carte pricing benefits the buyer and packaged or bundled deals give the advantage to the seller.” His rationale is clear – unbundled pricing creates transparency for the buyer. As Tjian puts it, when a potential buyer sees the unbundled price of a bundle, “…the customer is more likely to be ticked off by the price” of the bundle.

This is a very transactional approach to the relationship between buyer and seller. The idea that members of the sales team might serve as trusted advisors to buyer stakeholders is foreign to this attitude. Packaging becomes a shell game with the buyer, forcing customers to pay for items in the prix fixe menu that they don’t value. This view envisions sales conversations with procurement agents instead of with operating managers looking solve a problem. The assumption is that buyers have a low cost of search and a low cost of negotiating price. This view is unlikely to align with a company’s sales training nor is it likely to drive sales effectiveness.

3. “Bundles are a bad sales habit to provide discounts.” At the other end of the spectrum, packages are viewed as an “acceptable,” or even “normal,” way for an organization to discount. Sales professionals offer package discounts, sometimes routinely, as a way to increase sales to a given customer.

Cynical finance and pricing professionals see requests for package discounts as a signal that their sales teams are unable to sell differentiation or value. They see it as evidence of sales temptation to side with a customer seeking a price concession. In the view of finance or pricing, sales teams are not completely spineless – increasing demand by selling a bundle is better than just dropping the price – but there is often innate skepticism among finance and pricing teams that packages and bundles are necessary. This attitude views packaging as a second-best tool for give-get negotiation.

In a subsequent installment in this blog series, we argue that well-designed package solutions need not imply discounts, especially when value selling is successfully implemented. We also suggest that, even if market circumstances prescribe packaged solutions as a means to discount for specific segments, packages for other segments should not necessarily be discounted or offered at all.

These three attitudes do not result in good offer design, nor do they result in effective value communication. Great offer design takes a deliberate view of packaged solutions and their pricing based on a good understanding of differentiation, segmentation, quantified value, and clear communication.

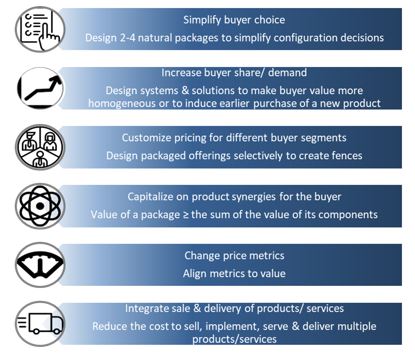

6 Reasons to Package. There are six good reasons to go beyond a la carte product and services offerings to packaged systems and solutions. In summary, they are:

1. Simplify buyer choice. Packaged offerings shorten sales cycles by making it easier for buyers to choose an effective combination of products and services. Packages reduce the buyer cost of search and avoid complex decisions about configurations.

2. Increase buyer demand. Offered together with a full a la carte menu, a packaged solution represents an additional alternative for customer choice, potentially at a discount, and thus is a way to increase demand. Economists have written extensively about this reason for packaging, often with anti-trust policy in mind.

3. Customize pricing for specific buyer segments. Offering a combined package that only applies to specific segments is a way to erect pricing fences, making it possible to price differently across different value-based segments.

3. Customize pricing for specific buyer segments. Offering a combined package that only applies to specific segments is a way to erect pricing fences, making it possible to price differently across different value-based segments.

4. Capitalize on product and/or service synergies for the buyer. Some combinations of differentiated products deliver more value to the customer when purchased in combination than the sum of the value they deliver if purchased one-at-a-time. In this case there are genuine value synergies to the buyer.

5. Change price metrics. Offering a packaged system or solution can provide a useful means to change price metrics to a metric more aligned with customer value. Transitioning from selling individual products in units that relate only loosely to value, the packaged solution can be offered based on a metric that facilitates more profitable value-based decisions.

6. Integrate sale & delivery of products and services. Combining products and services into a package often has direct implications for how they are sold and delivered. Reducing the cost to serve customers can be good for both buyers and sellers, creating opportunities to both reduce prices and increase profitability.

These six reasons are not mutually exclusive reasons to package a system or a solution, but they do have different implications. This blog series will try to draw out those implications clearly. In the next three blogs, we will explore two of these six reasons at a time, using illustrative examples as a way to make each reason more concrete. In practice, good offer design involves identifying which sub-list of these 6 reasons are important objectives in choosing packaged solutions. This helps to structure and price offers more effectively in designing a go-to-market strategy.

Value Based Decision-Making, Pricing and Selling. A central theme of this blog series is that quantifying and communicating value are essential in designing differentiated product and service packages. Understanding value is central to good innovation and product launch disciplines. We plan to show how quantified value helps with good offer design by identifying segments, by looking at value by segment, by considering value synergies, and by customizing package pricing accordingly.  Planning for how value will be communicated is mission critical in achieving the best results from selling value-based packaged solutions.

Planning for how value will be communicated is mission critical in achieving the best results from selling value-based packaged solutions.

Great B2B organizations are customer-centric. Innovative businesses benefit by making their product and pricing decisions based on customer value. Value conversations bring the customer’s business problems into focus, highlighting product, service and solution differentiation in terms of the customer outcomes delivered. These conversations foster collaborative customer relationships and improve the success of offers designed, driving higher revenues, greater profitability, and faster uptake of new systems and solutions at launch.

For additional perspectives on quantifying customer value see:

Can Your Sales Team Sell Your Solution’s Value?

To learn more about how sales teams use Value Propositions see:

Value Propositions for B2B Sales Effectiveness