Picture the marriage of two large enterprises. Each one brings an array of B2B products and services sold to the same customers. The starting point for post-merger integration consists of two groups of product managers, two sales teams, two service & support teams, and two cultures. Their first integration challenge is to build a single, effective commercial organization that preserves market share and drives faster growth. The initial chaos is intense: new org charts that include senior management from both sides, new assignments of roles, resignations, and layoffs. When the dust settles and the new teams get back to work, the remaining sales people invariably start with more products and services in their bag than before. The product management and marketing teams, usually reduced in headcount, struggle to revise plans and drive revenues for their many products and services, many of which are new to individual product managers’ portfolios.

This always means greater management complexity and a need for sales training. If the new product management teams fail to take a strategic approach, the post-merger commercial picture will be a long list of products and services smashed together into an extended, incoherent menu. Even with expensive, team-building investment in offsite workshops and training, the remaining sales reps usually end up more effective at selling what they sold before. Product managers usually gravitate to what they already understand. As a consequence, current customers drift to competitors able to capitalize on the post-merger chaos.

Cataclysmic events like this occur all the time in B2B. As highlighted in the first blog of this series, M & A is increasingly prevalent as a means to drive growth in complex products and to fold in services that are disrupting the way that customers buy. To simplify organizational integration and to capitalize on post-merger combinations of products and services, the best B2B organizations consider offering “packaged” or “bundled” systems and solutions. Prix fixe offerings can improve the performance of a business whose a la carte offering lists have gotten long and complicated, but only if those prix fixe offerings are well-designed.

Cataclysmic events like this occur all the time in B2B. As highlighted in the first blog of this series, M & A is increasingly prevalent as a means to drive growth in complex products and to fold in services that are disrupting the way that customers buy. To simplify organizational integration and to capitalize on post-merger combinations of products and services, the best B2B organizations consider offering “packaged” or “bundled” systems and solutions. Prix fixe offerings can improve the performance of a business whose a la carte offering lists have gotten long and complicated, but only if those prix fixe offerings are well-designed.

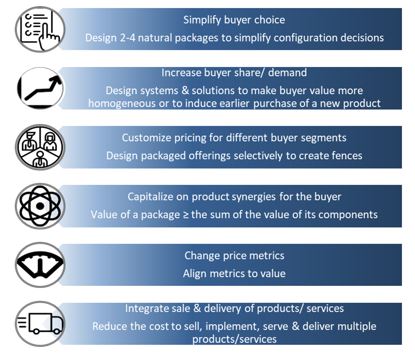

Great Offer Design and Customer Value. Quantifying value and communicating value are essential in structuring differentiated B2B product and service packages. In this blog series, we use specific examples to show how customer value and good value propositions improve the design and execution of effective go-to-market strategies. In part 1 of the series, we provided broader context for designing packaged offerings, reviewed three mistaken approaches to bundling, and introduced the following six good reasons to package systems and solutions:

Great Offer Design and Customer Value. Quantifying value and communicating value are essential in structuring differentiated B2B product and service packages. In this blog series, we use specific examples to show how customer value and good value propositions improve the design and execution of effective go-to-market strategies. In part 1 of the series, we provided broader context for designing packaged offerings, reviewed three mistaken approaches to bundling, and introduced the following six good reasons to package systems and solutions:

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.- Increase buyer demand. Packaged solutions can provide additional alternatives for customer choice, potentially at a discount, becoming a way to increase demand.

- Customize pricing for specific buyer segments. Providing combination packages that apply to specific segments supports different pricing across specific, value-based segments.

- Capitalize on product/service buyer synergies. Packages of differentiated products and services frequently deliver more value to customers when purchased in combination than the sum of their a la carte value when purchased individually.

- Improve price metrics. A packaged system or solution often provides a way to change the price metric previously used for products or services to a metric more aligned with customer value.

- Integrate sale & delivery of products and services. Combining products and services into a package frequently has direct implications for how they are sold and delivered, reducing the cost to acquire, retain and serve customers.

These six reasons to package have different implications, even when several of them apply to a situation simultaneously. In part 2 of the blog series, we considered the first two: simplifying buyer choice and increasing demand. In this third installment in the blog series, we explore the middle two of these six reasons, segmentation and synergies, in greater depth. Understanding value has a direct bearing on the design, pricing, and communication consequences for packaged offers that are priced to segmented buyers and that capitalize on value synergies.

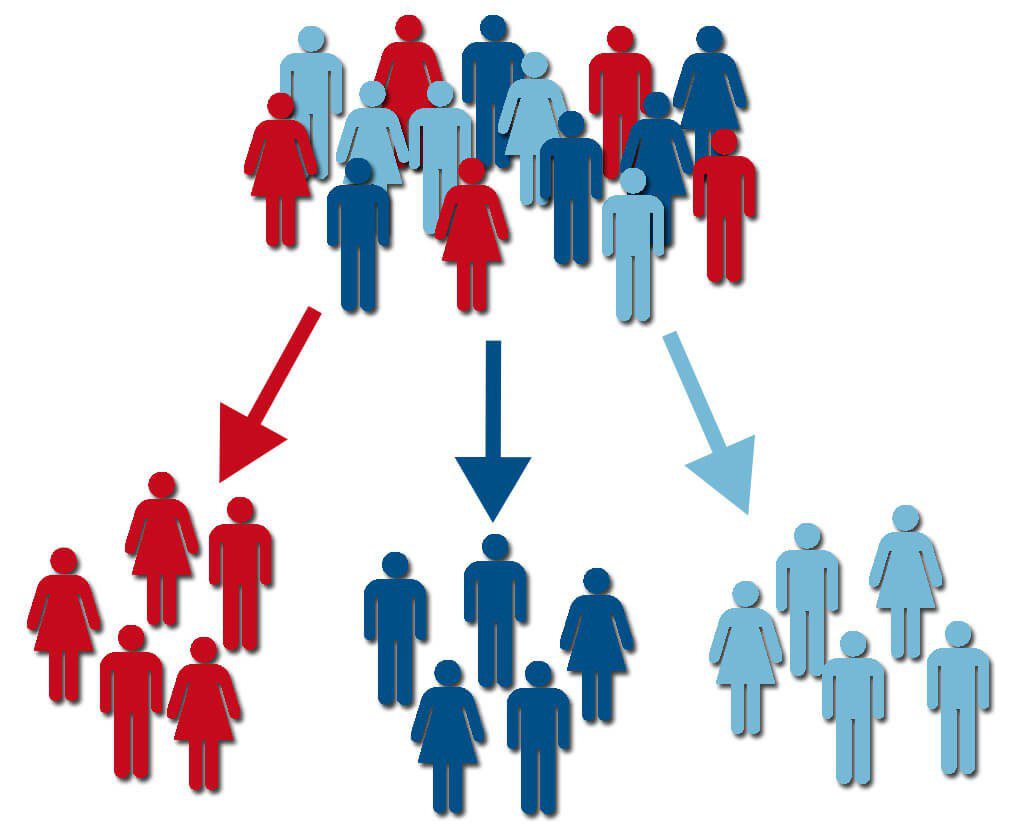

3. Target Packaged Solutions to Different Segments

Buyer Segmentation. The better a commercial team’s understanding of its buyers, the more adept they will be at designing offerings targeted to segments. At one level, designing packaged offerings to fit buyer segments is common sense, but at a strategic level, it is also an opportunity to increase revenue and improve profitability. When a team develops a deeper qualitative and quantitative understanding of value, they have the tools to identify value-based segments. With those segments in mind, they can structure packaged offerings that target specific segments, setting segment-specific prices for the packaged solutions. Sometimes these segments naturally separate themselves in the market by different demands from different buyer groups. Sometimes the packages themselves create identifiable fences, or at least low stone walls, those identifiably separate buyers into distinct segments.[1]

Buyer Segmentation. The better a commercial team’s understanding of its buyers, the more adept they will be at designing offerings targeted to segments. At one level, designing packaged offerings to fit buyer segments is common sense, but at a strategic level, it is also an opportunity to increase revenue and improve profitability. When a team develops a deeper qualitative and quantitative understanding of value, they have the tools to identify value-based segments. With those segments in mind, they can structure packaged offerings that target specific segments, setting segment-specific prices for the packaged solutions. Sometimes these segments naturally separate themselves in the market by different demands from different buyer groups. Sometimes the packages themselves create identifiable fences, or at least low stone walls, those identifiably separate buyers into distinct segments.[1]

There are several ways to think about packaged offerings that capitalize on value-based segments, all of which are discussed at greater length in The Strategy and Tactics of Pricing:

Packages to Target High-Value Buyers. A prix-fixe packaged solution can be targeted toward identifiable buyer segments who realize a high value from multiple products and services, leaving lower-value buyers to choose from an a la carte menu or among lower-value packages. Often, platinum and gold packaged solutions represent offerings that fit the high-value buyer, not only as a way to simplify the offering or increase wallet share but also as a means to focus high-value buyers’ selection on a combined offering that extracts a portion of their higher valuation. If a full menu of la carte products is made available, opportunities may be limited in trying to extract premium pricing for packages. On the other hand, there is seldom a good reason to discount a prix fixe offering for high-value buyers relative to a la carte prices.

Packages to Increase Demand by Low-Value Buyers. A packaged offering may include one or more products or services that are exclusively demanded by, or more attractive to, low-value buyers. These packages can be discounted relative to a la carte prices, increasing market share in the low-value segment. A discounted price for a package targeting low-value buyers induces them to purchase products or services that they would not have purchased otherwise, without discounting a la carte prices that are acceptable to high-value buyers.

“Selectively Ugly” Packages to Target Low-Value Buyers. Sometimes features or products can be added to a package that is either unattractive or unacceptable to high-value buyers. These low-grade packaged offerings can be discounted relative to higher-grade products or packages. Nagle and Muller cite the “selective uglification” example of “industrial grade” chemicals that cannot be used for pharmaceutical applications or in human food. By adding ingredients that are unacceptable for high-value buyers, the low-grade offering can be targeted to low-value buyers at a reduced price, while preserving higher prices for high-value buyers.

Case Study 3: SciGrow – Get More Out of a Product & Service Portfolio

Case Study 3: SciGrow – Get More Out of a Product & Service Portfolio

Situation: Two substantial companies in the agriscience business merge to become SciGrow, largely agricultural products, and services company providing seeds, crop protection products, and innovative services to farmers. Their price list, post-merger, is extensive.

Portfolio Products. SciGrow has developed a new herbicide for corn and soybeans. It has a high value in addressing a broad spectrum of weeds that harm both crops, but the new herbicide faces a lower-priced competitor in soybeans than in corn. In addition, field studies for the new herbicide are limited so far, with a lower recorded increase in soybean yields than in corn yields compared to the next best herbicide in each market. Comparative analysis of herbicide and seed yields have so far only been done stand-alone and not in combination.

Based on comparative studies, SciGrow’s post-merger seed offerings for corn and soybean both result in higher yields than the competition with correspondingly higher values. They have been historically priced at a premium to competing seeds.

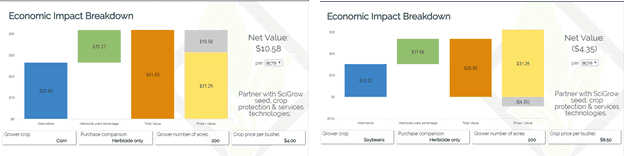

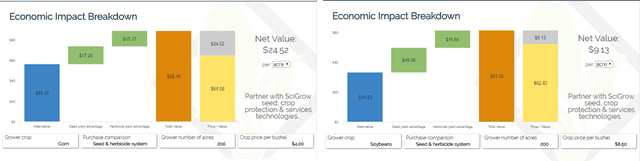

A la Carte Pricing. At a price of $1,000 per gallon for the herbicide (for approved application rates for corn and soybeans), the novel herbicide provides a strong business case to buy for corn farmers. At that price, however, the herbicide’s yield advantage for soybean farmers is insufficient to justify a business case to buy it. Corn and soybean value waterfalls are shown side by side.

(L) Corn Net Value for Herbicide Only, (R) Soybean Net Value for Herbicide Only

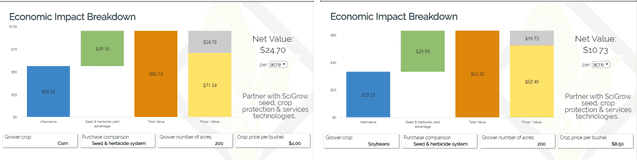

Packaged Solutions. Providing packaged prices for seed and herbicide together provides an opportunity to discount the package selectively to the soybean farmer, say by 10%, turning the business case to buy the package positive. There is no reason to discount a seed-herbicide package offered to corn farmers relative to a la carte prices, given its higher value.

(L) Corn Package Net Value, (R) Soybean Package Net Value

A la Carte Offerings and Pricing. SciGrow can continue to provide a la carte pricing at the same levels, but with its selective discount, it establishes a business case for soybean farmers to buy both its seed and its herbicide by purchasing the discounted package.

Communication and Sales. SciGrow’s primary online and printed product information focuses on the benefits of the package both for soybeans and corn. Additional a la carte information is provided for corn and soybean seeds as well as for herbicide for corn.

Implications for Offer Design and Pricing. When based on identified differences in value, packages provide an opportunity for segmented pricing that may not be possible for individual products or services. Packages can be offered with differential discounting relative to a la carte prices depending on segments. On its own, and in the absence of other reasons to package segment-oriented packages:

- Provide discounts for the prices of some, but not all, packages in comparison to the prices of their a la carte components.

- Need not drive an organization to eliminate a la carte pricing. The pricing structure means that per unit profitability is higher for products or services bought a la carte than for packaged solutions. Segmentation is a reason for packaging that tends to imply a mix of a la carte offerings and packages, an outcome economists call “mixed bundling.”

Implications for Value Communication. For packages targeted to penetrate a segment that is hard to reach with a la carte offerings, communication should be focused on the benefits of the package, not its individual components. The Value Proposition for this segment is both stronger and simpler for the package than individual Value Propositions for package components. For segments with packages that are priced flat to a la carte prices, there is less reason to confine messaging and promotion to packages, but providing parallel package information for these segments alongside a la carte information usually makes sense.

4. Packaged Solutions to Capitalize on Buyer Synergies

Buyer Synergies. All too often, product managers, working in a compartmentalized culture with decentralized incentives, evaluate packages or bundles based on simple arithmetic. Put several products together, attach one or two services, add up their value, add up their prices and the packaged offering is defined. Their math neglects the possibility that 1+1=3, often ignoring their C-suite’s mantra, repeated over and over to Wall Street, that their businesses are synergistic. Post-merger shareholder value never realizes its potential. Organic growth in multi-product companies is restricted by a lack of imagination and the absence of collaboration.

Buyer Synergies. All too often, product managers, working in a compartmentalized culture with decentralized incentives, evaluate packages or bundles based on simple arithmetic. Put several products together, attach one or two services, add up their value, add up their prices and the packaged offering is defined. Their math neglects the possibility that 1+1=3, often ignoring their C-suite’s mantra, repeated over and over to Wall Street, that their businesses are synergistic. Post-merger shareholder value never realizes its potential. Organic growth in multi-product companies is restricted by a lack of imagination and the absence of collaboration.

There are two potential types of synergy that arise when products and services are packaged together: (1) buyer synergies and (2) cost synergies. Both represent a strong reason to package. In part 4 of the blog series, we explore cost synergies. In this section, we focus on buyer synergies.

B2B Product Synergies. Economists define complementary goods for B2C in statistically measurable terms, as having a negative cross elasticity of demand. If the price of one good rise, the demand for the second good falls. Analogously, in production theory, there is substantial economic literature on complementary inputs relevant to B2B where buyer and seller market power are often focal points of the analysis and where contracting is frequently examined from a policy perspective.

At a practical level, complementary products are important in many B2B settings. A module offered by a software business is frequently only relevant to customers who already use the gateway or platform module provided by that business. Often integrating the module into a competitor’s software platform is expensive, technically impossible or does not make strategic sense. From the buyer’s perspective, the modules are strong complements. Diagnostic equipment and lab testing instruments are sometimes engineered to be more efficient for buyers when used together with other equipment offered by the same vendor. One product strategy for innovative disposables is to design them in a way where they only work with the same vendor’s instruments. Spare parts provided by many equipment manufacturers are complementary products in the sense that they work better than competing spare parts with that company’s equipment, or that they are more durable or more reliable than the alternatives. Seeds are designed with traits that make them complementary with some crop protection products. Drugs are designed to be more effective in cocktails with other products used in specific therapies.

In each of these cases, the value of buying and using several products together, as a system, is greater than adding up the a la carte value of using each product stand-alone. In terms of customer value, there is identifiably or measurably greater value to purchasing the products together. Product synergies characterized by value synergies are widespread in B2B

B2B Service Synergies. Similarly, B2B services are often synergistic with B2B products and with other B2B services. Data services and information services are often offered in a way that they are only useful when used together with a platform or a gateway subscription service offered by the same vendor. Support and maintenance services are frequently offered by equipment manufacturers that are both exclusive to their own instruments and are more valuable than competing services to the buyer. The equipment manufacturer’s greater knowledge and experience of their own equipment uniquely positions them to provide value to customers, but their value is greater for their own equipment customers than for customers purchasing competing equipment. Service businesses are often developed inside manufacturing companies precisely to make customers more successful in using the manufacturer’s products, thereby enhancing the value of their product purchase and driving recurring revenues.

Many products and services together are synergistic in creating buyer value. For offerings that are strategically important to the buyer, this is prime territory for entering into collaborative partnerships and long term contracts. It is also prime territory for solution selling, where complementary services are sold as part of a buyer’s purchase of a piece of equipment or a gateway product.

Case Study 4: SciGrow – Packages Designed for Value Synergies

Case Study 4: SciGrow – Packages Designed for Value Synergies

Situation: As in the previous case study, SciGrow offers seeds, crop protection products and innovative services. As before, their ground-breaking seed offerings for corn and soybeans drive higher yield for both crops than the competition. Their novel herbicide has a greater advantage for corn farmers than for soybean farmers on a stand-alone basis.

New Product Development Strategy. SciGrow’s post-merger innovation priority is to develop their seed portfolio by adding traits that make their best-in-class seeds resistant to their novel herbicide. After an investment in development, they move their new seed offerings for corn and soybeans toward launch.

Launch Preparation. Based on their value hypotheses, they perform more extensive field testing than they had done previously for seeds and herbicides. In multi-site trials, they compare: (1) their new seed varieties (with herbicide-resistant traits) treated with their novel herbicide, (2) their new seed varieties treated with the next best-competing herbicide, (3) their previous best-in-class seeds treated with their novel herbicide, and (4) their previous best-in-class seeds treated with the next best herbicide. To bolster their previous positioning in seeds, they include the next best competing seed varieties with both their novel herbicide and with competing herbicides as comparator arms in the trials.

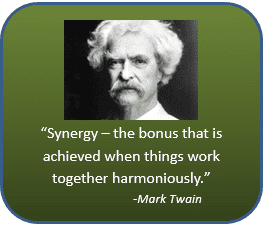

New Seed Results A La Carte. The results show no difference in yield for either corn or soybeans when comparing their new seed with their previous seed in the presence of competing herbicides. The benefits of their previous seed varieties versus competing seed varieties are also borne out when competing herbicides are used.

On a stand-alone basis, there is no case to be made for premium pricing of the new seed. Without SciGrow’s novel herbicide, the new seed shows the same advantage to the competitor’s seeds as previous SciGrow seeds.

(L) Corn Seed Net Value (background: Competing Herbicide), (R) Soybean Seed Net Value (background: Competing Herbicide)

New Seed Results in Combination. By contrast, when combined with SciGrow’s novel herbicide, the trial results show a significant difference in yield for both corn and soybeans when comparing their new seed with their previous seed. There is a significant additional value from synergies between the new seed and the herbicide

Packaged Solutions. Seeing the better results in combination, SciGrow prices both corn and soybean seed packages that also include the novel herbicide (in amounts that correspond to the acreage covered by seed) priced above packages with the previous seed. For corn, the package price is 10% higher. For soybeans, it is 2% higher.

(L) Corn Package Net Value (SciGrow Seed & Novel Herbicide), (R) Soybean Package Net Value (SciGrow Seed & Novel Herbicide)

A la Carte Offerings and Pricing. SciGrow maintains pricing for the novel herbicide a la carte at previous levels. With package pricing for the corn package above the previous seed a la carte prices, SciGrow sets a stand-alone price for new corn seed greater than the previous seed by an amount that more than fully reflects higher package prices. This pricing steers customer conversations to the packaged combination where SciGrow’s advantage is greatest. Because of the high new corn seed price, there is a disadvantage to the farmer in considering unbundled prices. A la carte pricing for the new corn seed, if it is made available at all, is irrelevant to the market.

Although the package price for soybeans remains below the a la carte prices of the previous seed and novel herbicide, SciGrow also sets a stand-alone price for new soybean seed higher than the previous seed by an amount that more than reflects the package price premium. Although no farmer doing the math would buy the new soybean seed stand-alone at this premium, the pricing structure keeps customer discussions and price checking simple.

Communication and Sales. With buyer synergies for SciGrow products bought in combination, there is only a downside to promoting a la carte offerings separately, even if a la carte prices are still available. If farmers consider buying the new seed or the novel herbicide stand-alone, they will not capitalize on SciGrow’s greatest competitive advantage, based on using the products together. A la carte information only muddies the waters. With synergies between the products, it is in SciGrow’s strategic interest to shift all of SciGrow’s promotion to focus on the benefits of the package for both soybeans and for corn.

Implications for Offer Design and Pricing.

The possibility that buyers realize value synergies from products and services bought in combination is worth exploring as soon as it is identified. When buyer synergies are important, they are a good reason to pivot pricing and offering focus toward packages and away from a la carte offerings. If buyer synergies are present, adding up the stand-alone value of the components of a package underestimates the value of the differentiated combined package. To realize the greatest value in a go-to-market strategy, it is critical to understand applicable synergies, design technology, and market research to test for combination effects and find evidence to validate claims for packaged systems or solutions. Value models and Value Propositions should focus on relevant combinations, not on shopping cart math for individual components. Pricing based on package value should become primary versus pricing to a la carte or stand-alone value. On its own, and in the absence of other reasons to package synergy-targeted packages:

- Set premium prices for packages where synergy is present in comparison to the sum of component pricing based on stand-alone value.

- Drives the commercial organization away from a la carte pricing. Competitive advantage is greatest for packages. A la carte offerings create noise. With new offerings based on combinations, avoiding a la carte pricing for components altogether may be a possibility. The economists call a situation where only packages are offered “pure bundling.” If a la carte pricing is retained for historic or tactical reasons, a la carte prices should be raised to reflect or exceed package prices to reduce or eliminate customer unbundling for price reasons. When value is effectively communicated for synergistic packages, scalability and profitability will be greater if focused on packaged systems or solutions.

Implications for Value Communication. For synergistic packages, communication should be dedicated to the benefits of the package, not its individual components. The value of the package, as it is validated, is simpler to communicate than adding up a series of diverse, stand-alone value drivers. The Value Proposition for the package is both stronger and simpler than individual Value Propositions for package components.

Summary: Value-Based Decision-Making, Pricing, and Selling. Understanding, quantifying, and communicating value is essential in designing differentiated product and service packages. The six reasons for packaging highlighted above have very different implications. In practice, good offer design involves identifying which sub-list of these six reasons applies in a given situation to set objectives in structuring and pricing packages. Having explored the middle two of these reasons in this blog, we will explore the last two of these six reasons in the next blog, continuing to use illustrative examples, before we step back to look at the larger picture for packaged solutions in the fifth installment of the series.

Understanding value is central to good innovation and product launch disciplines. It helps to structure and price offers more effectively in designing go-to-market strategies. Quantified value helps with good offer design by identifying segments, understanding value by segment, considering value synergies, and tailoring package pricing accordingly. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Understanding value is central to good innovation and product launch disciplines. It helps to structure and price offers more effectively in designing go-to-market strategies. Quantified value helps with good offer design by identifying segments, understanding value by segment, considering value synergies, and tailoring package pricing accordingly. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Great B2B organizations are customer-centric. Innovative businesses perform better if they base their offering and pricing decisions on customer value. Value discussions bring the customer’s business problems into focus, highlighting product, service, and solution differentiation based on the customer outcomes delivered. In sales, value conversations generate collaborative customer relationships and accelerate sales cycles, driving higher revenues, greater profitability, and faster uptake of new systems and solutions at launch.

To learn more about how to quantify value see:

Can Your Sales Team Sell Your Solution’s Value?

To learn more about how sales teams use Value Propositions see:

Value Propositions for B2B Sales Effectiveness

[1]See Thomas T. Nagle and Georg Müller, The Strategy and Tactics of Pricing, A Guide to Growing More Profitably (Routledge, 6th edition, 2018), pp. 80-85 for a discussion of offer design and bundles to target segments and pp. 95-101 for a discussion of fences.