Great product managers understand customers’ needs and communicate clearly how their product addresses them. For B2B customers, there is one universal need: improved profitability. That need is embedded in our economic system and in any set of management objectives.

The clearest way to communicate how a product improves profitability is a quantified Value Proposition. Value Propositions connect buying a product or solution to an inherent customer need. Providing a quantified Value Proposition to sales should be a no-brainer. A Value Proposition creates the quantitative business case to buy that can become the foundation for a customer’s decision to invest and to change.

Yet many product management and marketing teams don’t create quantified Value Propositions, even when they have world-beating products. Is it really that hard?

Absolutely not. Let’s look at how the best enterprises deliver value.

The Skills. The myth has developed in some organizations that quantifying value is an art that can only be performed by specialist consultants. Oddly enough, most of these organizations sell complex products developed to address the specific technical and business challenges of their customers. The product manager, by the job description, is required to understand product complexity, technical details, and specific product applications.

Any product manager who understands how a complex product works and who can communicate how it applies to a customer’s technical needs already has the aptitude to quantify value. It isn’t rocket science. All it takes is some high school math and intellectual curiosity to ask a few questions about the customer’s business. The process of building a quantitative Value Proposition is straightforward, requiring a few hours and a few disciplined steps.

The Motivation. Winning requires both skills and motivation. The incentive to build Value Propositions for sales should be clear enough. CRM data from organizations using Value Propositions in sales show that opportunities where a Value Proposition is used: (1) have 5-15% higher win rates and (2) 5-25% higher price outcomes. It is not hard to see why.

Value Propositions improve B2B sales team performance, addressing sales challenges throughout the B2B sales cycle. For account executives and sales reps, they are useful early in the sales cycle in call preparation, in building sales confidence, in qualifying opportunities, and in engaging customer executives. For technical sales and presales professionals, joining a customer-facing team in the middle of the sales process, Value Propositions are an important way to address presales challenges and maximize the impact of presales.

Sales and presales teams, working together, use Value Propositions to highlight differentiation and cut through complexity as they collaborate with customer stakeholders to build a shared business case to buy. The outcome, by design, is that sales teams using Value Propositions effectively become trusted customer advisors.

3 Hurdles to Leap. That said, there are predictable points where teams get hung up in creating value content, generating the B2B equivalent of writer’s block. Three objections or hurdles recur as teams quantify customer value. Let’s look at each and how they can be overcome.

3 Hurdles to Leap. That said, there are predictable points where teams get hung up in creating value content, generating the B2B equivalent of writer’s block. Three objections or hurdles recur as teams quantify customer value. Let’s look at each and how they can be overcome.

-

- No Differentiation. The first question that stumps some teams is a fundamental marketing question. How is our product different from the competition? The fact that it takes some teams hours to answer this question often indicates a need to improve product development processes. Even so, getting to an answer is real progress in understanding a product’s positioning. In order to identify points of differentiation, the team has to figure out: (1) the alternatives in buyers’ decision-making processes to their product – alternatives often include the status quo as well as direct competitors, (2) how their product is different from the alternatives and (3) why a buyer would consider substituting their product for a competitive alternative.Usually, some differentiation emerges and the team is off to the races as they start with differentiated features to get to customer benefits as a basis for quantifying value. Sometimes, however, a team can’t find their way out of the quagmire and are unable to identify real points of differentiation. At that point, it is a good idea to ask whether the team is looking in the right places. Differentiation is sometimes hidden in service, reliability, and other less tangible value drivers that can be quantified if the team works through the customer’s business.

If, after a tough tire-kicking exercise, a team can’t identify any differentiation then maybe it’s time to ask some more fundamental questions. If products aren’t differentiated, how is R & D choosing their priorities? If undifferentiated products have been prioritized for significant marketing resources and significant sales efforts, then perhaps it’s time to direct commercialization resources and efforts in different directions. It may also be time to reconsider the price.

If, after a tough tire-kicking exercise, a team can’t identify any differentiation then maybe it’s time to ask some more fundamental questions. If products aren’t differentiated, how is R & D choosing their priorities? If undifferentiated products have been prioritized for significant marketing resources and significant sales efforts, then perhaps it’s time to direct commercialization resources and efforts in different directions. It may also be time to reconsider the price.

- No Differentiation. The first question that stumps some teams is a fundamental marketing question. How is our product different from the competition? The fact that it takes some teams hours to answer this question often indicates a need to improve product development processes. Even so, getting to an answer is real progress in understanding a product’s positioning. In order to identify points of differentiation, the team has to figure out: (1) the alternatives in buyers’ decision-making processes to their product – alternatives often include the status quo as well as direct competitors, (2) how their product is different from the alternatives and (3) why a buyer would consider substituting their product for a competitive alternative.Usually, some differentiation emerges and the team is off to the races as they start with differentiated features to get to customer benefits as a basis for quantifying value. Sometimes, however, a team can’t find their way out of the quagmire and are unable to identify real points of differentiation. At that point, it is a good idea to ask whether the team is looking in the right places. Differentiation is sometimes hidden in service, reliability, and other less tangible value drivers that can be quantified if the team works through the customer’s business.

-

- Too many customer situations, offerings & competitors. Teams quantifying value often get hung up at the very first specific quantitative question. The answer to an early question all too often is “it varies” or “it depends.” Specific quantitative answers regarding how much better we are, and what that is worth to the customer, often change with: (1) the type of customer, (2) which version of our product we are offering, and (3) who the competitor may be in the customer’s buying process.

“It depends” should never cause gridlock. The best way to get started in quantifying value is to be specific in terms of customer type, offering, and competitor. This often seems puzzling, especially to those who start with the ambition to create a universal Value Proposition out of the box. But a concrete set of answers, specific to customer type, offering, and competitor, helps to make the substance of our Value Proposition real and helps the team visualize how a customer conversation is likely to work best. Refining a specific Value Proposition is a good way to maximize the quality of the underlying value content.

“It depends” should never cause gridlock. The best way to get started in quantifying value is to be specific in terms of customer type, offering, and competitor. This often seems puzzling, especially to those who start with the ambition to create a universal Value Proposition out of the box. But a concrete set of answers, specific to customer type, offering, and competitor, helps to make the substance of our Value Proposition real and helps the team visualize how a customer conversation is likely to work best. Refining a specific Value Proposition is a good way to maximize the quality of the underlying value content.

There is important and useful information in the early answers and the initial reactions of “it varies” and “it depends.” Keep track of the variations in customer type, offering, and competitor. Keep notes on how these variations are likely to change the elements of our Value Proposition, even if we are focused on a different specific case. Information about how the Value Proposition should change in these cases is important and can help identify possible customer segments. Later this information can help organize a single Value Proposition for simple use in the variety of customer situations that our commercial team is likely to face.

- Too many customer situations, offerings & competitors. Teams quantifying value often get hung up at the very first specific quantitative question. The answer to an early question all too often is “it varies” or “it depends.” Specific quantitative answers regarding how much better we are, and what that is worth to the customer, often change with: (1) the type of customer, (2) which version of our product we are offering, and (3) who the competitor may be in the customer’s buying process.

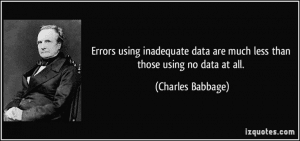

- The data aren’t good enough. The most frequent objection is probably the deadliest

objection. “The data aren’t good enough.” So how good do the data have to be? The quality of a Value Proposition can and should evolve through a product’s life cycle. Value Propositions have different uses and different users during a product’s development phases than they have during the product’s commercial phases.Often enough, product managers start simple. Then, as they understand their product better, as they understand its applications better, they fill in the details of their understanding of how their product helps their customer. The result is a Value Proposition that initially evolves toward deeper and more analytical. But in preparing for widespread commercial use of the Value Proposition, it is essential to simplify it again to improve communication.

objection. “The data aren’t good enough.” So how good do the data have to be? The quality of a Value Proposition can and should evolve through a product’s life cycle. Value Propositions have different uses and different users during a product’s development phases than they have during the product’s commercial phases.Often enough, product managers start simple. Then, as they understand their product better, as they understand its applications better, they fill in the details of their understanding of how their product helps their customer. The result is a Value Proposition that initially evolves toward deeper and more analytical. But in preparing for widespread commercial use of the Value Proposition, it is essential to simplify it again to improve communication.

Start by generating hypotheses, both for value driver formulae and for the underlying data. Publicly available data are often available as natural benchmarks. Experts, experienced reps, and selected customers can be helpful. Then test the value drivers and data. As people begin to use the product, hypotheses often turn into verified anecdotes and case studies. Development studies can provide powerful initial data. Market research, customer interviews, and surveys help as the product matures commercially. When the product reaches the market, we start to get into territory where tracking the data revealed in early customer conversations can help inform both the next customer conversation and the next broadly applicable version of the Value Proposition. Sales conversations and the data that come from them usually provide the best guidance as to what is replicable and will work best in the marketplace.

Start by generating hypotheses, both for value driver formulae and for the underlying data. Publicly available data are often available as natural benchmarks. Experts, experienced reps, and selected customers can be helpful. Then test the value drivers and data. As people begin to use the product, hypotheses often turn into verified anecdotes and case studies. Development studies can provide powerful initial data. Market research, customer interviews, and surveys help as the product matures commercially. When the product reaches the market, we start to get into territory where tracking the data revealed in early customer conversations can help inform both the next customer conversation and the next broadly applicable version of the Value Proposition. Sales conversations and the data that come from them usually provide the best guidance as to what is replicable and will work best in the marketplace. Charles Babbage, the father of modern programmable computers, provided a useful perspective on the question of data quality. “Errors using inadequate data are much less than those using no data at all.” Data quality is a process, not a destination. Be agile. Quantify value fast and then refine.

Charles Babbage, the father of modern programmable computers, provided a useful perspective on the question of data quality. “Errors using inadequate data are much less than those using no data at all.” Data quality is a process, not a destination. Be agile. Quantify value fast and then refine.

In sum, generating strong quantitative Value Propositions is not hard. Product managers can create great value content that serves as the foundation for useful sales tools. Product managers should:

- Focus on the customer and how a product improves customer business performance

- Quantify value specifically

- Ask creative and strategic business questions

- Take an agile approach by coming up with an initial version fast, then continuing to test and refine it.

The resulting Value Propositions are a shared basis for collaboration that help sales teams win.