Picture a company with an array of complex products including equipment, instruments, consumables, and/or disposables. These products are used in specific applications: surgery, agriculture, animal health, food production, lab testing, construction, or manufacturing materials or components for their customers’ production. Over time, the performance of these products, as customers use them, has been central to the success of the business. A service business has grown up that provides installation, maintenance, training, software upgrades, monitoring and other related services. The service business is 25% of the company’s revenue and its list of offerings is almost as long as the company’s list of products. The service business gets high marks on customer satisfaction. The product divisions rely on the service business, although they pay limited attention to selling services.

On a stand-alone basis, the service business is unprofitable.

This situation, and variations on it, are widespread in B2B. As highlighted in the first blog of this series, the explosive growth of innovative services has accompanied increasing complexity in product offerings. M & A is often deployed to drive growth, frequently looking to combine services with products applicable to the same customers. At some point, many businesses are compelled to consider whether their innovative services are lost on their customers or are underpriced.

This situation, and variations on it, are widespread in B2B. As highlighted in the first blog of this series, the explosive growth of innovative services has accompanied increasing complexity in product offerings. M & A is often deployed to drive growth, frequently looking to combine services with products applicable to the same customers. At some point, many businesses are compelled to consider whether their innovative services are lost on their customers or are underpriced.

To address this problem, the best commercial organizations design and launch “packaged” or “bundled” systems and solutions. Prix fixe packaged offerings can improve the performance of a business whose a la carte offerings have gotten complicated, but only if those packaged solutions are well-designed.

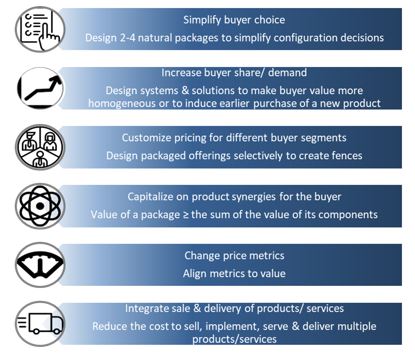

Great Offer Design and Customer Value. Quantifying value and communicating value are essential in structuring differentiated B2B product and service packages. In this blog series, we use specific examples to show how customer value and good Value Propositions improve the design and execution of effective go-to-market strategies. In part 1 of the series, we provided broader context for designing packaged offerings, reviewed three mistaken approaches to bundling, and introduced the following six good reasons to package systems and solutions:

Great Offer Design and Customer Value. Quantifying value and communicating value are essential in structuring differentiated B2B product and service packages. In this blog series, we use specific examples to show how customer value and good Value Propositions improve the design and execution of effective go-to-market strategies. In part 1 of the series, we provided broader context for designing packaged offerings, reviewed three mistaken approaches to bundling, and introduced the following six good reasons to package systems and solutions:

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.- Increase buyer demand. Packaged solutions can provide additional alternatives for customer choice, potentially at a discount, becoming a way to increase demand.

- Customize pricing for specific buyer segments. Providing combination packages that apply to specific segments supports different pricing across specific, value-based segments.

- Capitalize on product/service buyer synergies. Packages of differentiated products and services frequently deliver more value to customers when purchased in combination than the sum of their a la carte value when purchased individually.

- Improve price metrics. A packaged system or solution often provides a way to change the price metric previously used for products or services to a metric more aligned with customer value.

- Integrate sale & delivery of products and services. Combining products and services into a package frequently provides cost synergies in how they are sold and delivered, reducing the cost to acquire, retain and serve customers.

These six reasons to package have different implications, even when several of them apply to a situation simultaneously. In part 2 of the blog series, we considered the first two: simplifying buyer choice and increasing demand. In part 3, we looked at the middle two: price segmentation and buyer synergies. In this fourth installment in the series, we explore the final two of these six reasons, price metrics and cost synergies, in greater depth. Understanding value has a direct bearing on the design, pricing, and communication consequences for packaged offers that provide new price metrics and that drive cost synergies.

5. Change Price Metrics to Align to Value

Price Metrics.[1] A price metric is the unit to which price is applied, often defining what a buyer will receive for a price paid. Price metrics are often established by tradition or convention based on product or service features. The price metric for most physical products is based on how much of the product is sold, measured by weight (pounds or kg), volume (gallons or liters) or number (machines, instruments, plates, chips, pills, devices, sheets, or rolls). For services, traditional metrics regularly include elements of the cost to deliver the service: parts and labor or time and materials. Often, the price of a service is based on the volume of the service delivered: number of subscribers, number of transactions, number of visits, number of procedures or number of names accessed from a database.

Aligning Price Metrics. Features of a product or service and the benefits provided to customers are sometimes highly correlated. But if there is a complex relationship between features and benefits, or if there is significant buyer segmentation, feature-based price metrics often constrain the ability of a commercial team to realize the value of their offering. Choosing a feature-based price metric that is more aligned with benefits or value is a good first step. For example, transaction-based software pricing may be more aligned with measurable customer value than user-based pricing. Fixed price, annual maintenance contracts are usually more aligned with uptime, which is what a customer cares about, than pricing based on parts and labor.

Aligning Price Metrics. Features of a product or service and the benefits provided to customers are sometimes highly correlated. But if there is a complex relationship between features and benefits, or if there is significant buyer segmentation, feature-based price metrics often constrain the ability of a commercial team to realize the value of their offering. Choosing a feature-based price metric that is more aligned with benefits or value is a good first step. For example, transaction-based software pricing may be more aligned with measurable customer value than user-based pricing. Fixed price, annual maintenance contracts are usually more aligned with uptime, which is what a customer cares about, than pricing based on parts and labor.

Benefit or Value-Based Price Metrics. At a certain point, choosing price metrics that are uncoupled from features, but are more directly related to benefits, presents an additional opportunity. For many offerings, benefits and value are a direct result of buying more than one product or service. Selling a packaged solution can be a natural way to make a switch in price metrics. In healthcare, for example, a full-service combination of implantable devices, instruments, and software for a surgical procedure can be a means to consolidate the different metrics, on which the underlying components were sold traditionally, into a single solution price. If the solution price is aligned with the way these components are used and the way they generate revenue for a healthcare provider (per procedure), providing a packaged solution is simpler and has a more predictable business impact for the provider.

Pricing packaged solutions based on benefits or value metrics is one way to change the terms on which components of the solution are purchased. Metrics that are better aligned with value help a seller realize greater value across segments. Even if some segments end up paying less than they would have otherwise, changing metrics often delivers a combination of greater demand and higher average prices. The new metric improves value based segmentation and often should replace the previous metric and replace the previous offering structure.

In some circumstances, packaged solutions with a different price metric add segments that were previously inaccessible. In these circumstances, adding solution offerings to the mix, without replacing previous offerings, may improve seller outcomes by expanding the array of alternatives available to different customers.

Structuring solutions that replace various price metrics with a consolidated price metric usually involves tradeoffs. For pre-existing products and services, it may mean some cannibalization of current demand. Solutions sometimes introduce cash flow timing that is different from that of stand-alone components (e.g. lease vs buy). Packaged solutions often involve different ways in which risk and reward are shared between buyer and seller. Prix fixe solutions may have different costs to serve than their underlying a la carte components (see the next section). Piloting solution programs is frequently a means to assess how a packaged solution impacts profitability.

Evaluating Price Metrics. Nagle and Muller provide useful criteria to help choose price metrics. These apply to packaged solutions, just as they apply to their underlying components. Good price metrics:

- Track with differences in value across segments,

- Track with differences in cost to serve,

- Are easy to measure and enforce,

- Facilitate favorable positioning versus the competition,

- Align with how buyers experience value in use.

Ex Ante vs. Ex Post Pricing: Performance-Based Metrics. Value based pricing takes some companies further when they entertain the possibility of value based contracts where payments are based on actual outcomes. In this case, the price is not fully known at the time of purchase (ex ante) but is based on results once the purchase has been implemented (ex post). Performance or outcomes based contracts are often more complicated than standard purchase arrangements. They make the most sense when some combination of the following apply:

- Post-purchase outcomes are more uncertain,

- Outcomes require substantial performance by both seller and buyer after the sale,

- The purchase decision is important for both seller and buyer,

- The seller’s offering is highly differentiated,

- The buyer has significant market power.

In these situations, it is sometimes natural to establish a collaborative, contractual relationship between innovative seller and powerful buyer. These are situations where having a deliberate discussion of how risk, reward and value are shared makes the most sense.

As with any approach to risk-sharing, the two primary challenges of insurance and risk management should be considered for any performance-based price metrics that are widely offered:

- Adverse Selection. When information asymmetries between the parties are significant, objective measurement of outcomes may be difficult, pricing may not reflect differences in risk, and potentially the only parties interested in sharing risk are high risk parties.

- Moral Hazard. Risk-sharing potentially changes behavior. The energy or effort needed to drive the success of an arrangement may be disincentivized by terms of the risk-sharing agreement.

Ex post, performance based contracts are complex in other ways. Outcomes based contracts are bound to lengthen sales cycles. Lack of certainty frequently makes revenue recognition and other accounting issues a challenge. The cost of entering into, administering and enforcing contracts is invariably higher. Having the flexibility to capitalize on opportunities or respond to unanticipated changes is often problematic. That said, there are no better value-based-price-metrics than those that share risk and reward based on value actually delivered.

Case Study 5: SciGrow – Package Pricing for an Innovative Service

Case Study 5: SciGrow – Package Pricing for an Innovative Service

Situation: SciGrow, a post-merger agriscience business (see previous blog), has been using a number of methods to track the practices and outcomes of farmers. As their database has grown, they have used statistics and artificial intelligence to predict and optimize growing performance. Among outcome improvement practices identified by SciGrow, several address: (1) how and when SciGrow seeds should be planted, (2) how crops should be treated using SciGrow crop protection products.

They develop a computer portal, with supporting training and advisory services, as a way to deliver their predictive analytics to their customers. Their challenge is to choose a go-to-market strategy for their “Optimization Service.”

SciGrow considers offering it primarily to distributors and retailers, contingent on minimum business volumes being met, but decide that their new service is a way to access their end users directly. They consider offering their service to growers for free, but decide that the best way to build value in the service is to make it a profit center.

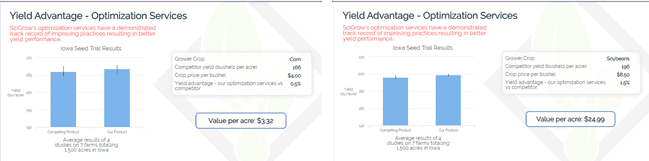

Optimization Service Benefits. The data from their pilot program demonstrates significant average added value of their service for corn and soybean farmers. But the service’s impact is different, with an advantage for soybean farmers that is over six times that for corn farmers.

(L) SciGrow Service – Corn Yield Benefit, (R) SciGrow Service – Soybean Yield Benefit

Stand-alone Service Pricing. When they consider the need to support customers, SciGrow’s first instinct, aligned with standard software-as-a-service pricing, is to offer their Optimization Service as a subscription at a fixed annual cost per subscriber. While the subscription approach is simple, it doesn’t distinguish between corn and soybeans, failing to capture the superior value that SciGrow’s service provides to soybean farmers.

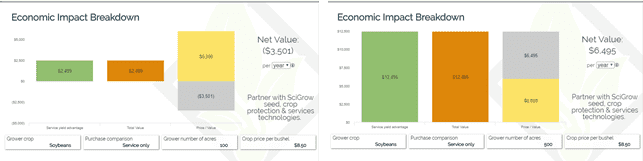

More importantly, charging a fixed price per subscriber does not align with value delivered across farmers of either crop. The larger the farm, the greater the benefit per year of the Optimization Service. A comparative business case to buy is shown side by side for a small soybean farm (100 acres) and a larger soybean farm (500 acres) at subscription pricing of $6,000 per year where the farmer does not substitute the Optimization Service for another service. A small farm buying the subscription service loses money. A large farm obtains an ROI of over 100% on its service purchase.

(L) Soybean Net Value for 100 acre farm Soybean Net Value for 500 acre farm, (R) Subscription Service Pricing Subscription Service Pricing

Packaged Solutions. In the previous blog, we saw how SciGrow realized more value by packaging prices for seed and herbicide together, as they targeted segments and buyer synergies. SciGrow takes the approach of offering Optimization Services only in combination with seed/herbicide packages, moving toward a full service solution as its primary approach to these markets.

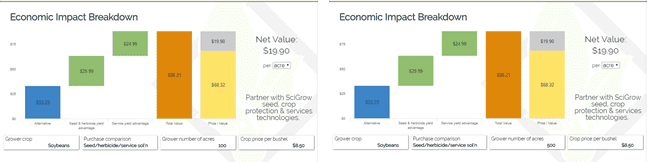

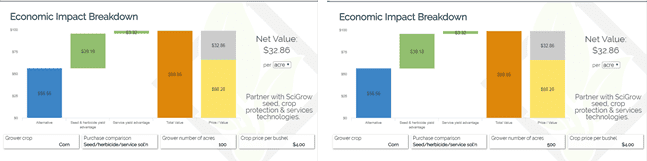

SciGrow charges a higher package price with services than it would have charged without them by $20 an acre for soybean farmers and $5 an acre for corn farmers. Instead of launching Optimization Services with a per user metric, SciGrow launches the services with a price metric more aligned with value – per acre. The packaged solution provides a natural way, not only to segment pricing of the service but also to implement a better price metric.

The business case to buy is shown side by side for different size soybean farms.

(L) Soybean Net Value for 100 acre farm – Packaged Solution, (R) Soybean Net Value for 500 acre farm – Packaged Solution

The business case to buy is shown side by side for different size corn farms as well.

(L) Corn Net Value for 100 acre farm – Packaged Solution, (R) Corn Net Value for 500 acre farm – Packaged Solution

A la Carte Offerings and Pricing. SciGrow may continue to provide a la carte pricing, but its solution becomes its primary offering, enabling it to set prices that get greater value out of its superior solution. With the change in price metrics, the price of services is higher than it would have been for large farms and lower than it would have been for small farms.

The use of solution pricing facilitates an offering of the Optimization Service that obtains higher value from soybean farmers, yet also enables SciGrow to sell the service to corn farmers, implicitly offering them a lower price that matches their lower value. If the cost of providing services has a meaningful fixed component per subscriber, SciGrow may wish to set their primary solution price at a discount to the level they would charge for small solution purchases.

Communication and Sales. SciGrow’s primary online and printed product information focuses on the benefits of the enhanced package, including Optimization Services, both for soybeans and for corn. They provide la carte product and service information on request.

Implications for Offer Design and Pricing. Packaged solutions often provide an opportunity to set or reset a price metric to be more aligned with value. On its own, and in the absence of other reasons to package, designing packages to reset price metrics:

- Results in a mixture of price outcomes for different customers, some of whom face higher prices and some of whom face lower prices.

- Generally drives an organization towards only offering package pricing. Packages are often fundamental to implementing a better price metric. Providing offerings with unaligned metrics gets in the way of a better pricing strategy, except possibly in transition. If any a la carte pricing is offered, it should generally be set at a premium versus package pricing, unless a la carte offerings are themselves targeted toward specific segments. Realigning metrics is a reason for packaging that suggests that offering strategy focus on packages, an outcome economists call “pure bundling.”

Implications for Value Communication. For packages designed to reset price metrics, communication should focus on the benefits of packaged solutions, not their individual components. The Value Proposition for the solution is stronger, simpler and more widely applicable for the package than individual, a la carte Value Propositions. Driving the market toward better price metrics based on the solution is an important communication objective.

6. Packaged Solutions to Capitalize on Cost Synergies

Cost Synergies & Integration. Almost every merger press release and every acquisition spreadsheet includes pro forma estimates of cost reductions. Cost synergies from operating two businesses together are usually fundamental to the rationale for combining two businesses.

Cost Synergies & Integration. Almost every merger press release and every acquisition spreadsheet includes pro forma estimates of cost reductions. Cost synergies from operating two businesses together are usually fundamental to the rationale for combining two businesses.

Attempting to capture cost synergy is also a prime motivation for many corporate reorganizations. Businesses operating separately often grow large serving the same customer, but the sale and delivery of products and services are usually not as efficient as they might be if they were provided by a single, coordinated business organization.

Whether or not there are buyer synergies that result from packaged solutions, there are often synergies for the seller.

One Stop Shop – The Cost of Acquiring New Business. The arguments for cost synergies in sales are clear enough. A single sales rep, targeting a new account, is likely to be a better sharpshooter, prioritizing the most valuable business, learning how the account operates, and connecting the dots between different parts of a customer organization. A single account manager, handling an existing account, is likely to understand the problems of the account more broadly, to navigate decision-making politics better at the account and to seize opportunities to cross-sell and up-sell. The success of consolidating sales responsibilities depends on sales incentives and, more importantly, on the knowledge and skills of the sales force. Packaged solutions support the realization of cost synergies by reducing the number and complexity of offerings for sales teams to sell. This improves the efficiency of new account acquisition and current account management.

One Stop Shop – Implementing and Supporting Customers. The integrated delivery of services and support is a best practice for minimizing the cost of goods or cost of sales. A single person accountable for implementation services is more likely to be an effective coordinator than multiple individuals who lose track of what their colleagues are doing and end up repeating customer conversations or working at cross purposes. With one individual serving the account, the customer knows where to go to ask questions, solve problems, and obtain satisfaction. That individual is more likely to take a strategic approach to the account’s success and to make reasonable tradeoffs to improve customer outcomes. To achieve these benefits, once again, skills and knowledge are required. Packaged solutions support cost synergies by focusing the delivery of multiple products and services on the delivery of fewer packaged solutions, the success of which can be supported more efficiently.

Realizing Product & Service Direct Cost Synergies. In most multi-product and multi-service businesses, there are direct cost relationships across the portfolio between products and services. For example, a better maintenance service may result in longer useful equipment life. If equipment is sold to the customer separate from maintenance services, one offering (maintenance) tends to reduce sales of the other offering (equipment) over time. Leasing the equipment to customers, where the maintenance service is embedded in the terms of the lease, provides a packaged approach allowing the seller to obtain some of the benefit of longer equipment life. The package in this case becomes a way to capture benefits that would otherwise be lost by one offering cannibalizing sales of a second offering.

Case Study 6: SciGrow – Packages to Realize Cost Synergies

Case Study 6: SciGrow – Packages to Realize Cost Synergies

Situation: As in the previous case study, SciGrow offers seeds, crop protection products and services. Their seed, herbicide and Optimization Service offerings for corn and soybeans drive higher yield for both crops than the competition. They have structured and implemented packaged solutions of seed, herbicide and services tailored to the corn and soybean segments.

Optimization Service Discovery. Based on further data analysis, SciGrow extends the predictive analytics in their Optimization Service. Their findings indicate that refined use of their herbicide (in timing and application rates) improves outcomes. Based on simulation analysis, they estimate that, if these improved practices are implemented, the average use of their herbicide is would be reduced by 25% over likely weather scenarios in their major markets.

The A La Carte Challenge. If SciGrow separately offered their Optimization Service and their herbicide a la carte, they would have a business problem. With this new discovery, prescriptions from their Optimization Service would cannibalize herbicide sales by amounts comparable to their revenue from the Optimization Service.

Package Adjustments and Package Pricing. SciGrow has made the shift to selling packages of seed, herbicide and services as their primary offering. The price of their solution is specified regardless of the herbicide actually provided. Knowing prescribed application rates of herbicide in advance, based on their service, they are able to provide necessary amounts of herbicide in the right dose each year for that year’s conditions. They lower the package price by about 5% of the previous herbicide cost, reflecting their lower cost in part, but they realize much of the value of reduced herbicide application themselves. Admittedly the profile of their profitability for these packages varies with annual conditions, but they are able to realize greater profit on average from their herbicide sales.

Packages, A la Carte Offerings and Pricing. With hindsight, SciGrow is fortunate to have decided to offer Optimization Services only in solutions packaged with herbicide and seeds. Their combined solution delivers the highest crop yield available, and they are able to capitalize on their continuous innovation in services, regardless of the implications for changing the mix of products they deliver.

Communication and Sales. SciGrow’s product information and Value Proposition focus on the benefits of their best-in-class, packaged solutions which they sell on a per acre basis. Their disruptive solution results in their driving further technological refinements. As their complete solution becomes integral to the operations of their best customers, they consider piloting alternative ways to share risk and reward with growers.

Implications for Offer Design and Pricing. When cost synergies drive solution offerings, the only way for buyer and seller to realize and share the economic benefits of integration is from packaged solution sales. If cost savings are a dominant reason for packaging, a la carte offerings are inefficient for buyer and seller. There is little reason to offer them and no reason to offer them at a discount. Market research should focus on the claims for packaged solutions. Value Propositions should focus on relevant combinations, and on fitting the right combination to different customer segments. Pricing based on package value becomes primary versus pricing based on a la carte or stand-alone value. In the absence of other reasons to package, packages targeting cost synergies:

- Imply discounted prices for packages in comparison to the sum of any component pricing offered.

- Drive the commercial organization away from a la carte offerings. Competitive advantage is greatest for packages. This situation, where only packages are offered, is another case of “pure bundling.”

Implications for Value Communication. When cost synergy is important, communication should be targeted toward the benefits of the package, not its individual components. The simplicity of communicating package value may contribute to the additional economic value of the package and should not be watered down with extra information about individual components, except as needed to address questions.

Summary: Value Based Decision-Making, Pricing and Selling. When designing differentiated product and service packages, understanding, quantifying and communicating value are critical. As highlighted throughout this blog series, the six reasons for packaging highlighted above have different implications. In practice, good offer design involves identifying which one or several of these six reasons are most important in a given situation. This helps to set clear objectives in structuring and pricing packages and in managing the remainder of the product and service portfolio. In the next and final blog of this series, we will step back to look at the broader context of how far to go in packaging solutions, as we also consider some of the reasons to avoid or move away from bundled solutions, back toward a la carte product and service offerings.

Understanding value is central to good innovation and product launch disciplines. It helps to structure and price offers more effectively in designing go-to-market strategies. Quantified value helps with good offer design by identifying segments, understanding value by segment, and identifying value and cost synergies in order to tailor package pricing accordingly. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Understanding value is central to good innovation and product launch disciplines. It helps to structure and price offers more effectively in designing go-to-market strategies. Quantified value helps with good offer design by identifying segments, understanding value by segment, and identifying value and cost synergies in order to tailor package pricing accordingly. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Great B2B organizations are customer-centric. Innovative businesses perform better if they base their offering and pricing decisions on customer value. Value selling conversations with buyers bring the customer’s business problems into focus, highlighting product, service, and solution differentiation based on customer outcomes delivered. In sales, value conversations generate collaborative customer relationships and accelerate sales cycles, driving higher revenues, greater profitability, and faster uptake of new systems and solutions at launch.

To learn more about how to quantify value see:

Can Your Sales Team Sell Your Solution’s Value?

To learn more about how sales teams use Value Propositions see:

Value Propositions for B2B Sales Effectiveness

[1]See Thomas T. Nagle and Georg Müller, The Strategy and Tactics of Pricing, A Guide to Growing More Profitably (Routledge, 6th edition, 2018), pp. 85-95 for a discussion of price metrics.