Value Coaches Ask Good Questions. Value coaches in B2B organizations are on a mission. Our objective is to drive our teammates to strong value content by asking the right questions. Previously, we drew parallels between coaching soccer in the three phases of the game and coaching commercial teams in the three stages of value management and value selling. Quantifying value is like playing midfield. Designing Value Propositions requires the skills of a good back or keeper. Teams selling value need to be effective strikers.

We opened our blog series on coaching midfielders to quantify value with best practices to frame the value discussion. A good framework provides clarity about what we are selling (our offering), who we are selling to (our customer), the comparison(s) our customer will make (our reference alternative), and the units they will use to measure our performance (customer units).

Having framed the discussion, the next step is to understand differentiation and identify value drivers. In this blog we focus on this more creative part of the process, pivoting toward quantified and dollarized value.

Differentiate and Identify the Sources of Value. Based on a good sense of the landscape, value players need to probe the competition to understand our competitive advantage. That advantage is our differentiation. It can be evaluated based on a comparison of product features (our offering), customer benefits (our impact on the customer), and the dollarization or euro-ization of what our benefits are worth (our financial value).

Good coaches’ questions zero in on how our offering is differentiated. Product and service managers often spend their energy making sure that our product works or that our services are high quality. Their to-do lists are frequently feature-centric. They habitually direct their attention towards elements of our offering that are “table stakes” or “must-haves.”

Good coaches overcome inertia by redirecting product managers towards customer value by:

- focusing attention on our differentiation,

- moving our teams beyond product-centricity (what we offer) to customer-centricity (the benefits and value our offering delivers).

Coaching sessions, drilling down into differentiation, often seem like a trip to the dentist. Good questions are often painful to product teams. Despite the discomfort these questions cause, they invite our players to be more strategic.

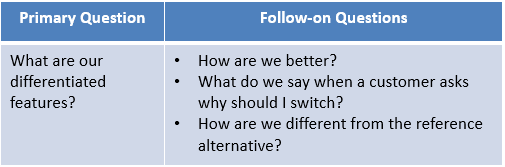

What are our differentiated features?

What are our differentiated features?

Identifying product features is usually easy, but we need to rise above the “must-haves” to identify features that are different. How are we better? How do we answer when a customer asks “why should I switch?” How do we compare to the reference alternative?

Although our objective is to understand differentiated benefits for the customer, it pays to clarify first how our product or offering is different. If we can’t identify ways in which our product is differentiated, we should look at services we offer in combination. If our differentiated features are unclear, then we should generate testable hypotheses. Unanswered coach’s questions about differentiated features signal a need for homework. If that work yields limited differentiation, then why are we investing time and money to develop and promote the offering? What are our differentiated benefits?

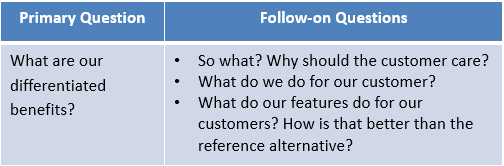

What are our differentiated benefits?

Next we need to shift our team’s attention from the to the customer. We may have a better offering, but so what? Why should the customer care? What do we do for our customer? What do our differentiated features do for our customer? How is that better than the reference alternative?

Our objective is to understand our offering’s differentiation from a customer’s perspective. By asking about benefits, we clarify what we do for our customer that is different. If our differentiated benefits are unclear then we should look at what our differentiated features do for our customer, then ask how the customer derives business benefit from these features. How do our benefits make money for the customer?

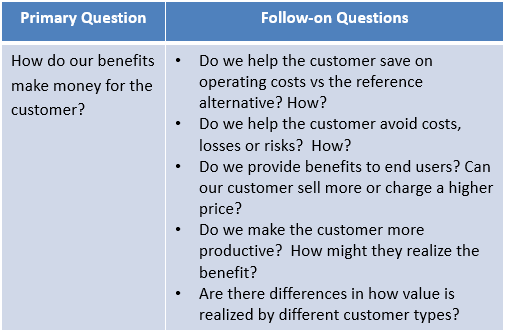

How do our benefits make money for the customer?

We are ready to identify value drivers by starting with our benefits and asking how those benefits have a financial impact for the customer. Do we help the customer save on operating costs? If so, how? Do we help the customer avoid costs, losses, or risks? If so, how? Do we provide benefits to customers of our customer? Can our customer sell more or charge a higher price? Do we make the customer more productive? How might they realize the benefit of that greater productivity? Are there differences in how value is realized by customer types?

We should think broadly as we identify positive value drivers. Our aim is to generate ideas about differentiated sources of dollarized value, including draft value statements, as starting points for quantification. Our initial list provides us with hypotheses to test. As we confirm qualitative hypotheses we will begin to get into more detail about how to quantify them. We can be more selective and simplify or consolidate these value drivers later. Differences we identify as to how value is realized by different customer types are worth tracking so that we can return to possible value-based segmentation after we have dollarized value for our initial customer type. Are there negative value drivers or costs of choosing our offering?

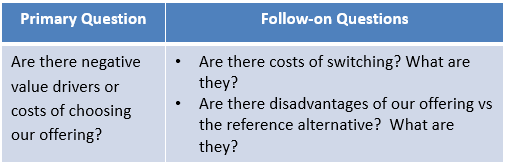

Are there negative value drivers or costs of choosing our offering?

Our offering may not be better in all dimensions than the reference alternative. Are there costs of switching to our offering? If so, what are they? Are there disadvantages of our offering vs the reference alternative? If so, what are they?

Asking questions about potential disadvantages customers face in purchasing our offering is only fair. As we think about pricing and communication, we should take the dollarization of those disadvantages into account. As we quantify these negative drivers, it may be worth considering longer horizon customer units (like contract life) as well as our approach to how and when we communicate them.

Get Past Objections to Quantifying Value. Teams sometimes get bogged down in answering an essential marketing question: how is our product different from the competition? If it takes our product development and product management team hours to identify feature differentiation and benefits, it is possible that our product development process needs an overhaul – introducing value conversations earlier in the product development process will help. Getting to answers on differentiated features, benefits, and value provides an understanding a product’s positioning and why a customer would buy.

As points of differentiation are identified, this often provides further clarity in how to frame the discussion by:

- identifying alternatives in buyer decisions, including the status quo and direct competitors,

- exposing whether our product substitutes for another solution or is an add-on,

- providing insights into why a buyer would consider substituting our product for an alternative.

Usually some differentiation emerges and the team is off to the races as we start with differentiated features to get to customer benefits as a basis for quantifying value.

Sometimes, however, a product team has a hard time finding their way out of the quagmire, and is unable to identify real points of differentiation. This is where having the team build a value map can help. We should also ask whether the team is looking in the right places. Differentiation is sometimes hidden in service, reliability, or other less tangible value drivers that can be quantified if the product team works through the customer’s business. Experienced sales team members can often provide insights as to how they sell this product or other products successfully.

Sometimes, however, a product team has a hard time finding their way out of the quagmire, and is unable to identify real points of differentiation. This is where having the team build a value map can help. We should also ask whether the team is looking in the right places. Differentiation is sometimes hidden in service, reliability, or other less tangible value drivers that can be quantified if the product team works through the customer’s business. Experienced sales team members can often provide insights as to how they sell this product or other products successfully.

If, after a tough tire-kicking exercise, our team can’t identify any differentiation then it’s probably time to ask more fundamental questions. If new offerings aren’t differentiated, how is R & D choosing their priorities? If undifferentiated products have been prioritized for significant marketing resources and/or sales efforts, then perhaps it’s time to redirect these resources and efforts elsewhere. It may also be time to reconsider the offering’s price.

Great Midfield Play. Product managers, seeking to understand their customers better by quantifying value, benefit by clarifying their framework and by working through our differentiated features and benefits to identify value drivers. Value coaches, usually less familiar with the commercial landscape faced by teams they coach, find that asking differentiation questions after setting up a good framework is a quick way to understand the commercial challenges our team is trying to address. Translating features into benefits helps teams get in the mode of thinking like our customers as we consider how to engage them to test and quantify value hypotheses. A good framework and good hypotheses help us ask better questions and understand quantified value more efficiently.

Great Midfield Play. Product managers, seeking to understand their customers better by quantifying value, benefit by clarifying their framework and by working through our differentiated features and benefits to identify value drivers. Value coaches, usually less familiar with the commercial landscape faced by teams they coach, find that asking differentiation questions after setting up a good framework is a quick way to understand the commercial challenges our team is trying to address. Translating features into benefits helps teams get in the mode of thinking like our customers as we consider how to engage them to test and quantify value hypotheses. A good framework and good hypotheses help us ask better questions and understand quantified value more efficiently.

The outcome is that good, quantified value content supports value management and value communication. Value management drives strategic decisions aligned with sustainable customer success. Value Propositions provide core sales content to support sales team collaboration with customers by focusing on the business outcomes buyers realize by purchasing our solution. Midfielders see the field and probe their competitors better, setting up plays, and making better passes. More goals, more wins, and more championships are the consequence.