Coach to a Business Case to Buy. Good value coaches help their colleagues quantify the differentiated value of our offerings. That value provides a foundation for better pricing. Establishing value at the center of customer conversations enables sales teams to realize higher prices. Value coaches ask good questions about the business impact of our differentiation and about our competitors. A fair, objective comparison of value and competing prices, from a customer’s perspective, drive a stronger business case to buy.

Previously, we drew parallels between coaching soccer in the three phases of the game and coaching commercial teams in the three stages of value management and value selling. Quantifying value is like playing midfield. Designing Value Propositions requires the skills of a good back or keeper. Teams selling value need to be effective .

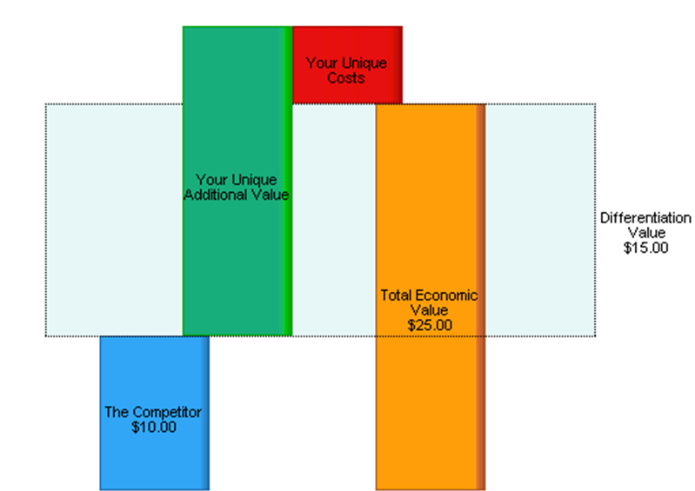

So far, in this series on coaching midfielders to quantify value, we have reviewed how to frame the discussion, how to focus on customer-centric differentiation, how to dollarize positive value drivers, and how to provide balance with negative value drivers. Based on a clear framework, and dollarized positive and negative value drivers, we need to consider the alternatives the customer might be considering to obtain a good estimate of the competitor’s price. The spending on a direct competitor that the customer saves is part of the total economic value we create.

Apples to Apples Comparisons. In framing the value discussion, we emphasized the importance of identifying both a clear reference alternative for comparison and customer-centric units. Both are essential in making good price and value comparisons:

A clear reference alternative may include not only a competing product, but also other associated components and services provided in the competing offering. Pricing a clear reference alternative takes the whole offering into account, possibly identifying differentiated elements of our offering, versus the alternative, that drive value.

A clear reference alternative may include not only a competing product, but also other associated components and services provided in the competing offering. Pricing a clear reference alternative takes the whole offering into account, possibly identifying differentiated elements of our offering, versus the alternative, that drive value.- Good customer units help in quantifying value drivers, but they also help in making an apples to apples comparison between the price of the competing offering and the price of our offering. Prices should be comparable in terms of a customer unit, rather than the unit we sell in, to make sure we take advantage of any efficiencies in how the customer uses our product or purchases our product relative to the competitor.

As mentioned previously, sometimes the reference alternative is doing nothing, or the status quo, in which case choosing our alternative results in no savings in direct spending on a competitor. In this case the price of the reference alternative is zero and we are looking to value drivers alone as we consider a value-based price.

In other situations, the customer considers buying our offering instead of a direct competitor. In this case the price of the competing offering that the customer saves, is an important part of the business case to buy our solution. Building competitive intelligence regarding the prices of competing offerings helps to refine our evaluation of the price we can charge.

Offering Components and Prices. We need to understand how the competitor’s offering and our offering will be purchased and will be used in practice to make apples to apples price comparisons. Identifying the components of a competing offering helps to recognize both the reference point for value drivers and the competitor’s price as the customer perceives it. Identifying the components of our offering helps us to think clearly both about value drivers and about how we should price individual components and packaged solutions.

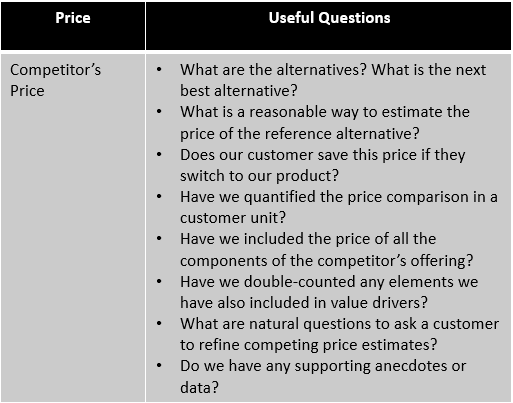

Here are a few good questions that value coaches should ask.

- Competitor’s Price. To quantify our differentiated value, we need to estimate the price of the competing offering that our offering will replace. That means understanding the market. What are the alternatives a buyer will consider instead of our offering? What is the next best alternative? The next best alternative provides the best reference for quantifying value and setting a price, but understanding our value relative to other alternatives can help in good value communication and in delivering a strong business case to buy.

What is a reasonable way to estimate the price of the reference alternative? Googling can help us find list prices and comments from other customers about what they have paid. Does our customer save this price if they switch to our product? If so, then this is a competing price that is part of the total economic value in a price waterfall. If not, then our business case to buy is based entirely on our value drivers, which might include the resale value a customer can realize by selling equipment made redundant by purchasing our offering.

What is a reasonable way to estimate the price of the reference alternative? Googling can help us find list prices and comments from other customers about what they have paid. Does our customer save this price if they switch to our product? If so, then this is a competing price that is part of the total economic value in a price waterfall. If not, then our business case to buy is based entirely on our value drivers, which might include the resale value a customer can realize by selling equipment made redundant by purchasing our offering.

Have we quantified our competitor’s price in a customer unit, per year, or per unit of the customer’s output? This is critical to apples to apples price comparisons if we create acquisition efficiencies where, e.g., a customer requires fewer pounds of our product than of a competitor’s product to produce the same output.

Have we included prices of all components of a competitor’s offering? They may be offering options a la carte that we include as part of a standard packaged solution. Have we double-counted any elements of the competitor’s offerings that are also included in value drivers? Good estimates include sources of value only once.

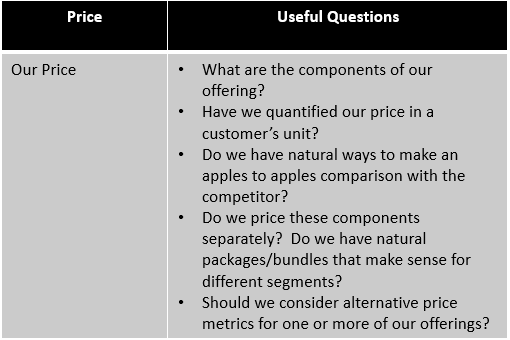

Then there are the questions that help us refine and discuss our estimates with buyers. What are the natural questions to ask a customer to refine competing price estimates? Do we have any supporting anecdotes or data? Keeping track as we improve our understanding is a best practice. - Our Price. The questions we ask about our price help to mold our pricing strategy, even if these questions are similar to those for direct competitors. What are the components of our offering? Have we quantified our price in a customer’s unit? Is the price comparison to the competitor apples to apples? Even though we assess the profitability of our offering based on prices in our offering unit, we need to set our price and communicate our price in customer-centric terms. Otherwise we will lose the discounting war to “sticker shock” or procurement games.

Then we start to get into quantification questions that feed our pricing and offer design strategy, that may include segmentation. Sometimes these questions are disconcerting to commercial teams, because our team traditionally has always offered our products, packaged or unpackaged, in a specific way. Often the team has not stopped to consider other approaches. Do we price our offering components separately? Do we have natural packages or bundles of our components that may make sense for different segments? There are also the “outside the box” questions that are worth putting on the table early. We can return to them later after seeing the value model as a whole. Should we consider alternative price metrics for one or more of our offerings? Perhaps there are price metrics that are better aligned with customer value than our traditional price metrics.

Then we start to get into quantification questions that feed our pricing and offer design strategy, that may include segmentation. Sometimes these questions are disconcerting to commercial teams, because our team traditionally has always offered our products, packaged or unpackaged, in a specific way. Often the team has not stopped to consider other approaches. Do we price our offering components separately? Do we have natural packages or bundles of our components that may make sense for different segments? There are also the “outside the box” questions that are worth putting on the table early. We can return to them later after seeing the value model as a whole. Should we consider alternative price metrics for one or more of our offerings? Perhaps there are price metrics that are better aligned with customer value than our traditional price metrics.

The aim early in value quantification is to set the stage for strategic pricing as we learn more about customer value. Eventually, as our value model evolves, we can consider value-based segmentation, offer design, and pricing strategies to capture value. By setting the price comparison framework early, we set ourselves up to ask better questions as we move toward a better pricing and value communication approach.

Overcome Barriers to Good Price Estimates. Some commercial teams find it difficult to estimate competitor prices, especially in markets where pricing lacks transparency or where competitors provide complex, customized solutions. Sometimes teams don’t know where to start. Get them to draw on internal expertise: a colleague who has worked at a customer or a competitor, a sales person who understands a customer’s business deeply, or an outside consultant with relevant experience where an hour’s worth of questions is good value for money. Then improve the estimation process by testing initial estimates and hypotheses with a good customer.

In markets with greater price transparency or with price data available in public or industry sources, teams usually have a better starting point. List prices or other comparable pricing samples are a good place to start. After all, our team will want our list prices to be aligned with other list prices, adjusted for our differentiated value. There is nothing wrong with an apples to apples comparison of value-based prices centered on list prices. If discounting versus list prices is frequent, then looking at comparable prices with comparable discounts is a second approach when considering our pricing strategy. Having more than one alternative in how prices are shown is a good approach in a Value Proposition where we want to keep assumptions clear and comparable. Ultimately, we need a basic communication strategy for our prices in customer conversations.

A good value coach keeps teams honest, driving objective and fair assessment of prices, both competitors and ours. Coupled with well quantified value drivers, these price estimates guide go-to-market strategy and content for customer conversations. A coach’s experience of how other products are offered, packaged, and priced builds commercial team confidence in pursuing internal and external sources to improve pricing estimates and strategy. Clear and flexible Value Propositions can be designed based on benchmark data. This approach elicits more information from a specific buyer without asking them direct questions that invite the buyer to answer with a price negotiation in mind. If value is established early in buyer conversations, then bringing up the competition helps to enhance buyer trust and improve sales effectiveness.

Better Midfield Strategy. Quantified customer value and prices are central to good midfield play. When we have quantified positive and negative value drivers and when we make apples to apples price comparisons, our team is set up strategically for better pricing, positioning, and go-to-market. That strategy feeds more profitable execution.

Better Midfield Strategy. Quantified customer value and prices are central to good midfield play. When we have quantified positive and negative value drivers and when we make apples to apples price comparisons, our team is set up strategically for better pricing, positioning, and go-to-market. That strategy feeds more profitable execution.

Value coaches drive teams to be objective in quantifying value and prices. They invite teams to be creative in identifying segments, potential offerings, and possible changes in price metrics. They provide perspective, experience, and advice as commercial teams work harder to understand their customers. If we understand how our product is used, we can make comparisons of comparable alternatives as we assess and measure how we improve our customers’ business. With plausible, comparable initial estimates of our offering’s net economics, we can refine estimated value drivers and prices.

The result is that good, quantified value and pricing content supports value management and value communication. Value management drives strategic decisions aligned with sustainable customer success. Value Propositions provide core sales content to support sales team collaboration with customers by focusing on the business outcomes that buyers realize. Midfielders build confidence in their offering as they assess the competition’s strengths and weaknesses. As a result, they move the ball downfield without trepidation to set up better shots on goal. More goals mean more revenues and greater profitability.