B2B account executives and customer success managers dread the customer decision point that every existing account deliberately confronts sooner or later.

Will they renew?

Even if the account has been on autopilot for years, a deliberate choice to remain our customer will eventually be prompted by a customer reorganization, a change in their team, a new technology that appears on the horizon, a different buying process, or pressure on their underlying business.

Sustaining business with existing accounts is the first objective of any account executive. It is the reason to have a customer success function. It is the goal of implementations, ongoing programs, product enhancements, support, and customer surveys. Retention and renewal are existential for customer success teams in the subscription economy and for B2B relationship managers more broadly.

Sustaining business with existing accounts is the first objective of any account executive. It is the reason to have a customer success function. It is the goal of implementations, ongoing programs, product enhancements, support, and customer surveys. Retention and renewal are existential for customer success teams in the subscription economy and for B2B relationship managers more broadly.

Our teams need to be ready for a simple customer question:

Why stay?

Teams who are blindsided by this question, whether or not they think well on their feet, are destined to fail.

Value is The Answer. A simple question deserves a simple answer. We can emphasize results from the recent past:

“This year, we helped you save $1.1 mm.”

Or we can look forward to plans for the near future:

“Next year we can help you realize $3.2 mm for an ROI of 450%.”

Although neither answer is as inspiring as the last song lyric the four Beatles recorded together, even for Lennon and McCartney, a relationship as exalted as love was transactional. If “the love you take is equal to the love you make,” someone must be keeping the books.

Although neither answer is as inspiring as the last song lyric the four Beatles recorded together, even for Lennon and McCartney, a relationship as exalted as love was transactional. If “the love you take is equal to the love you make,” someone must be keeping the books.

In business relationships, the math is that much more important. Warren Buffett defined the connection between buyer and seller in straightforward terms: “Price is what you pay. Value is what you get.” We know that our customers can measure our price. We need to make sure they can measure our value.

Lincoln Murphy put it succinctly: “…churn is just a symptom of an underlying disease. That disease is that our customers are not achieving their Desired Outcome.” Customers need to realize outcomes. A good value answer helps our customer defend their decision to stay. It helps deflect their attempt to negotiate the price.

The Customer Success Association definition of the customer success profession is more specific about the outcomes that matter. “Customer Success is a long-term, scientifically engineered, and professionally directed strategy for maximizing customer and company sustainable proven value.” The Desired Outcome of customer success is the realization of customer value. Value is measurable. To practice customer success scientifically in the era of big data, professionals working with existing accounts need to be able to quantify, demonstrate, and sell the financial value they deliver, post-purchase as well as pre-purchase.

The Customer Success Association definition of the customer success profession is more specific about the outcomes that matter. “Customer Success is a long-term, scientifically engineered, and professionally directed strategy for maximizing customer and company sustainable proven value.” The Desired Outcome of customer success is the realization of customer value. Value is measurable. To practice customer success scientifically in the era of big data, professionals working with existing accounts need to be able to quantify, demonstrate, and sell the financial value they deliver, post-purchase as well as pre-purchase.

Three Approaches to “Why Stay?” There are three approaches existing account and customer success teams take in preparing for the all-important “why stay?” question.

- Hope, Based on Activity and Gratitude. Often enough, teams avoid providing a direct, rational answer. They fall back on qualitative descriptions of their efforts and programs. Their survey questions fail to ask about outcomes and savings. They talk about health scores that measure activity and usage, hoping that their products and services are habit-forming. They look to build gratitude, knowing that, for existing accounts, status quo bias works in their favor.

Unfortunately, hope is rarely a sustainable strategy. Talking about activity and calling on debts of gratitude may help with individual stakeholders, but they never address a customer’s organizational imperatives. Delivered value is the continuing reason for a customer’s organization to do business with us, so why hesitate to talk about it?

Unfortunately, hope is rarely a sustainable strategy. Talking about activity and calling on debts of gratitude may help with individual stakeholders, but they never address a customer’s organizational imperatives. Delivered value is the continuing reason for a customer’s organization to do business with us, so why hesitate to talk about it?

- Perhaps our teams don’t understand how we improve our customers’ outcomes and financial results. If so, either we have a glaring hole in our product strategy or we are not providing our teams with good tools to measure value.

Perhaps our teams hesitate to talk about quantitative or financial outcomes, trying to avoid responsibility for customer results. If so, either cautious lawyers are directing our operating strategy or our commercial leaders are unwilling to hold our customer success and service teams accountable for delivering customer outcomes.

Perhaps our teams hesitate to talk about quantitative or financial outcomes, trying to avoid responsibility for customer results. If so, either cautious lawyers are directing our operating strategy or our commercial leaders are unwilling to hold our customer success and service teams accountable for delivering customer outcomes.- Perhaps our teams are uncomfortable discussing customer specifics and having value conversations because they feel that their data are never good enough. If so, they need confidence. They need to be trained. They need to be motivated to engage in meaningful customer conversations by managers, by mobilizers within our customer-facing organization, and by a record of others’ success.

The tradition of appealing to a customer’s loyalty is rapidly going the way of the dinosaurs.

Value Right Between the Eyes. In contrast to the first approach, the best existing account teams put customer value at the center of their strategy for account management and customer success. They design implementation and programs by targeting delivered value. They monitor realized value as part of their regular quarterly business reviews and executive reviews. They overcome the fear of talking value among their teams by training, coaching, implementing regular internal programs, and publicly featuring successful customer value discussions. They sustain value champions councils. Their C-suite talks value and imposes organizational discipline by asking the value question in management reviews. When it is time for the “why stay?” customer conversation, value – past and future – are the focal points for renewal and expansion proposals, plans, and presentations.

Value Right Between the Eyes. In contrast to the first approach, the best existing account teams put customer value at the center of their strategy for account management and customer success. They design implementation and programs by targeting delivered value. They monitor realized value as part of their regular quarterly business reviews and executive reviews. They overcome the fear of talking value among their teams by training, coaching, implementing regular internal programs, and publicly featuring successful customer value discussions. They sustain value champions councils. Their C-suite talks value and imposes organizational discipline by asking the value question in management reviews. When it is time for the “why stay?” customer conversation, value – past and future – are the focal points for renewal and expansion proposals, plans, and presentations.

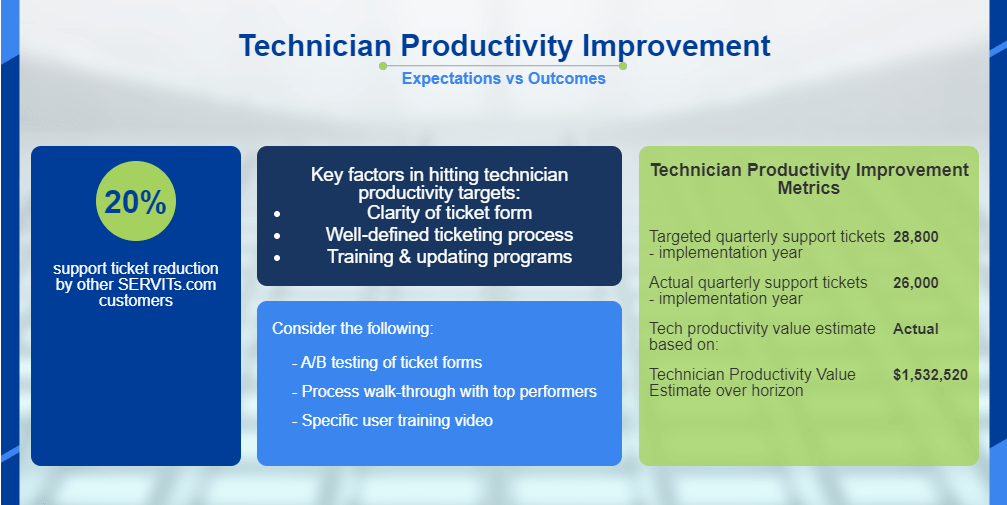

Let’s look at several examples of how financial value is a better way to evaluate success: Software. Implementing software to automate a business process reduces labor time spent on processing transactions. A customer has good data on labor time and costs spent per transaction prior to the software’s deployment. When assessing the success of the software, we could look at how many transactions were processed this year (an activity measure), how much labor time is being spent per transaction (an outcomes measure – made possible by the software), or estimate the labor cost avoided based on transactions processed, labor time savings, and the hourly cost of labor (a value measure). Making value the ultimate target supports the financial case for the renewal.

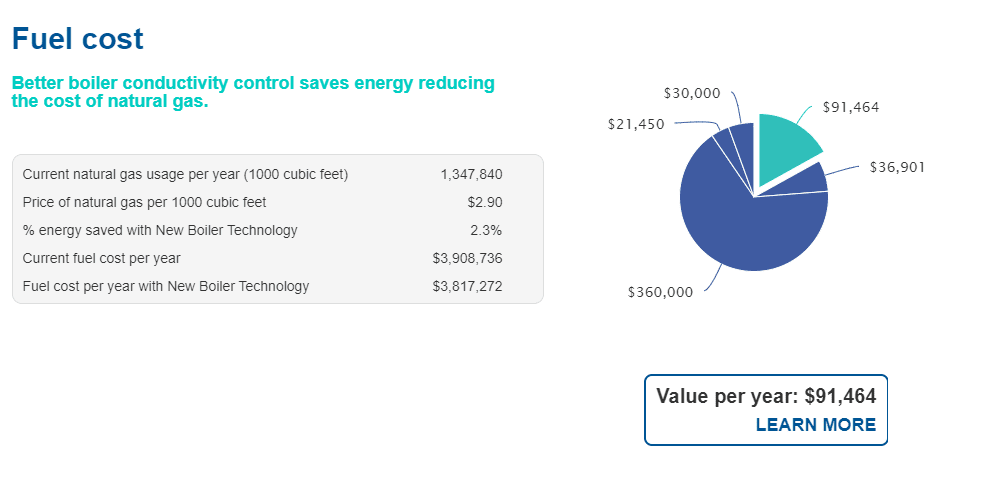

Software. Implementing software to automate a business process reduces labor time spent on processing transactions. A customer has good data on labor time and costs spent per transaction prior to the software’s deployment. When assessing the success of the software, we could look at how many transactions were processed this year (an activity measure), how much labor time is being spent per transaction (an outcomes measure – made possible by the software), or estimate the labor cost avoided based on transactions processed, labor time savings, and the hourly cost of labor (a value measure). Making value the ultimate target supports the financial case for the renewal. Specialty Chemicals. Installing new equipment along with the use of innovative chemical compounds reduces energy and water usage in an industrial boiler. The customer has good baseline data from metered billing. The success of the program can be described by a qualitative assessment of the installation (activity monitoring), a quantitative comparison of electricity and water usage (outcomes monitoring), or an estimate of the cost savings based on comparable prices per kWh and per gallon of water (value monitoring). Demonstrated cost savings makes the price of next year’s chemicals order a better conversation.

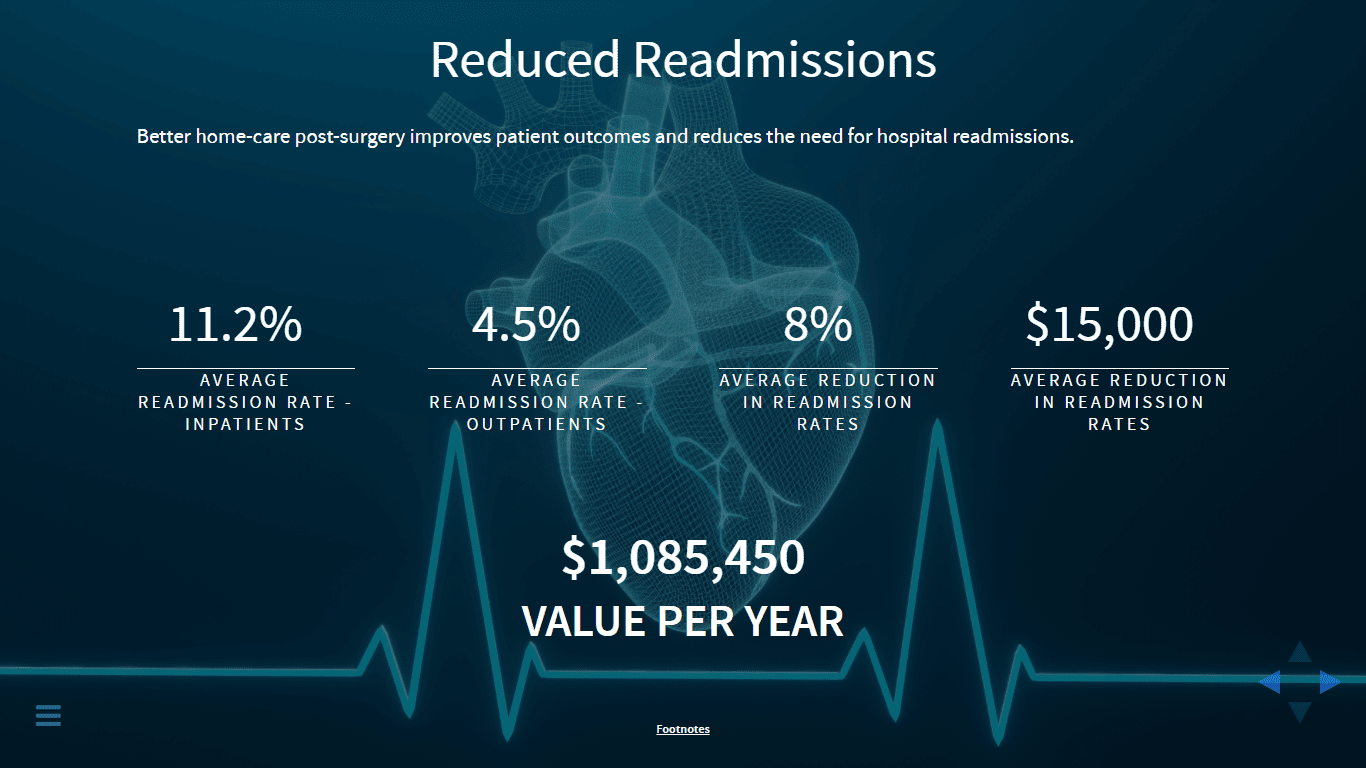

Specialty Chemicals. Installing new equipment along with the use of innovative chemical compounds reduces energy and water usage in an industrial boiler. The customer has good baseline data from metered billing. The success of the program can be described by a qualitative assessment of the installation (activity monitoring), a quantitative comparison of electricity and water usage (outcomes monitoring), or an estimate of the cost savings based on comparable prices per kWh and per gallon of water (value monitoring). Demonstrated cost savings makes the price of next year’s chemicals order a better conversation. Healthcare. A remote patient monitoring solution reduces hospital readmissions and speeds up hospital discharges. Its success can be assessed by the number of surgical patients monitored using the system (an activity measure), the readmission rates and length of stay data for patients in the program (an outcomes measure), or by dollarizing the savings based on the average cost of readmissions and of length of stay (a value measure). Demonstrated financial value is why hospital management should pay for next year’s program, despite tight budgets.

Healthcare. A remote patient monitoring solution reduces hospital readmissions and speeds up hospital discharges. Its success can be assessed by the number of surgical patients monitored using the system (an activity measure), the readmission rates and length of stay data for patients in the program (an outcomes measure), or by dollarizing the savings based on the average cost of readmissions and of length of stay (a value measure). Demonstrated financial value is why hospital management should pay for next year’s program, despite tight budgets.

In all three cases, activity measures and outcomes measures are useful in assessing performance, but the financial value of the solution is the natural primary endpoint in the “why stay?” conversation. A value-centric approach need not diminish the importance of activity, programs, health scores, or outcomes, but it views our existing account and customer success activities in the context of how and whether they deliver additional dollarized (or euro-ized) customer value. Plunging into the value conversation is as important for existing accounts as it is for new accounts.

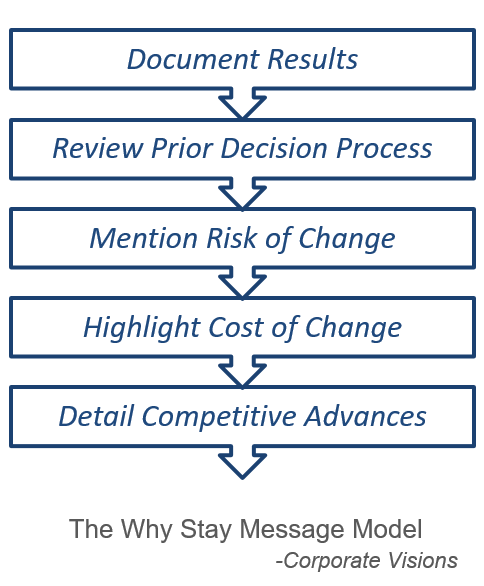

- Documenting results enhances credibility and reinforces preference stability. Interestingly, Corporate Visions uses an example in their tests that focuses on activity relative to goal, not outcomes or value.

- Reviewing prior decision processes is their next recommended step, as a means to reinforce preference stability by reminding the customer both that they have already done their due diligence and that the experience of evaluation was agonizing.

- Mentioning the risk of change helps to trigger anticipated regret and blame in order to appeal to a customer’s natural loss aversion as they consider staying.

- Highlighting the cost of change in time and resources is a direct means to reinforce the customer’s natural perceived cost of change.

- Detailing competitive advances reinforces selection difficulty by making the decision to change more complex, while advancing our competitive positioning.

3. Playbooks/ Messaging Frameworks. Increasingly B2B teams prepare deliberately to answer the “why stay?” question. One great approach is provided in The Expansion Sale, where Erik Peterson and Tim Riesterer from Corporate Visions highlight that messages for customer retention and expansion should be different from messages for customer acquisition. The “why change?” message model that is essential to overcoming status quo bias when acquiring new accounts is a disruptive approach. For existing accounts, disruption is no longer the fundamental objective. Status quo bias is on our side and we need to make the most of it when our objective is customer retention. Provocative messages are not the way to go.

3. Playbooks/ Messaging Frameworks. Increasingly B2B teams prepare deliberately to answer the “why stay?” question. One great approach is provided in The Expansion Sale, where Erik Peterson and Tim Riesterer from Corporate Visions highlight that messages for customer retention and expansion should be different from messages for customer acquisition. The “why change?” message model that is essential to overcoming status quo bias when acquiring new accounts is a disruptive approach. For existing accounts, disruption is no longer the fundamental objective. Status quo bias is on our side and we need to make the most of it when our objective is customer retention. Provocative messages are not the way to go.

Strong “why stay?” messages reinforce preference stability, selection difficulty, the perceived cost of change, and anticipated regret and blame, all factors that increase status quo bias. Corporate Visions tested three different messaging approaches and found that the “why stay?” model to the right increases an average customer’s intention to renew. The five steps of the model support retention:

Strong “why stay?” messages reinforce preference stability, selection difficulty, the perceived cost of change, and anticipated regret and blame, all factors that increase status quo bias. Corporate Visions tested three different messaging approaches and found that the “why stay?” model to the right increases an average customer’s intention to renew. The five steps of the model support retention:

In their previous book, The Three Value Conversations, How to Create, Elevate, and Capture Customer Value at Every Stage of the Long-Lead Sale, the Corporate Visions team uses term “customer value” unsparingly. “Customer Value” is in the book’s title and features in the header of each of the book’s three major sections. They advocate developing financial acumen in sales and there is an entire chapter on financial statements and ROI.

In their previous book, The Three Value Conversations, How to Create, Elevate, and Capture Customer Value at Every Stage of the Long-Lead Sale, the Corporate Visions team uses term “customer value” unsparingly. “Customer Value” is in the book’s title and features in the header of each of the book’s three major sections. They advocate developing financial acumen in sales and there is an entire chapter on financial statements and ROI.

The Expansion Sale seemingly presents a contrast. The word “value” appears no more than a handful of times. Delivering value gets a mention as an element of customer retention but it doesn’t take center stage the way it does in customer acquisition. The most consistent financial messages in The Expansion Sale are those about the cost of change.

Merging Customer Value with the “Why Stay” Message Framework. If the customer changed to our solution based on a vision of value, retaining the customer must have something to do with how we are delivering on that vision. The second and third approaches to “why stay?” are closer to each other than the language in The Expansion Sale might suggest.

Highlighting the cost of change in the Corporate Visions “why stay?” message is one natural place where anticipated financial impact is brought to bear on retention. Visualizing and quantifying the cost of change would provide a Value Proposition that compares our solution, as implemented, with a direct competitor the customer may be considering. If our product management team has done a good job understanding the competition, a quantified business case to stay vs changing to the competitor should be content that is easy to provide to sales.

Yet the first and foremost step in the “why stay?” message framework, documenting results, is where quantified, dollarized value is most impactful. The results the customer anticipated when they changed to our solution were the value delivered. If we want to do a good job documenting results, we need to go beyond measuring activity versus goal. We need to measure actual outcomes versus expected outcomes and actual value versus both price and expected value. By documenting value delivered at the start of the “why stay?” conversation, we can reduce the time we need to spend comparing our solution, the status quo, to a switch to a competitor. If we are delivering value, why consider a competing solution? If we are delivering value, then our solution is worth the price.

Refocus Existing Account Management. Transform the “why stay?” question into a more tangible question:

How much specific customer value do we deliver?

Usage and activity data, on their own, lack substance unless they are translated into customer outcomes and value. Answering the value question with anecdotes or unquantified customer benefits is more on point, but does not provide enough substance to support actions or budget decisions in our favor. A good, general, quantitative answer is better, providing messages about the magnitude of the value we deliver. But a specific financial answer for each customer is strongest of all, focusing on the problems that customer cares about, consultatively understanding that customer’s business, and quantitatively supporting that customer’s business case to renew.

Usage and activity data, on their own, lack substance unless they are translated into customer outcomes and value. Answering the value question with anecdotes or unquantified customer benefits is more on point, but does not provide enough substance to support actions or budget decisions in our favor. A good, general, quantitative answer is better, providing messages about the magnitude of the value we deliver. But a specific financial answer for each customer is strongest of all, focusing on the problems that customer cares about, consultatively understanding that customer’s business, and quantitatively supporting that customer’s business case to renew.

Whether or not we acquired our customers based on a value conversation, the stronger our Value Proposition, the better our chance of renewals and upgrades. When “why stay?” conversations are explicitly about the customer realizing greater value, there is little doubt that the seller and buyer are aligned.

The Next Normal: Value Propositions in Customer Success. Customer value conversations are accelerating as uncertainty persists in the COVID-19 era.

Customers are under heightened financial pressure to negotiate price or to cut expenses. Our teams need to deliver and talk measurable value. This will reduce the number of tough customer conversations at contract renegotiation time. When value conversations occur, our team can talk value first, then price.

Customers are under heightened financial pressure to negotiate price or to cut expenses. Our teams need to deliver and talk measurable value. This will reduce the number of tough customer conversations at contract renegotiation time. When value conversations occur, our team can talk value first, then price.- Customer teams face reorganizations – our current stakeholders may or may not be on the bubble. Even if our original sponsor bought into our product vision, their new approval process may hinge on what we deliver financially. Even if we sold a solution based on our technical capabilities and implementation program, the politics of our renewal may pivot on new people who may not understand our product’s details, insisting instead on outcome metrics and measurable ROI.

- Our customers face heightened uncertainty in their personal lives, and in how they will interact with our team. Sustaining their attention will be correspondingly more difficult. Our customer success team needs to engage customers with focused memorable content that keeps them participating, whether they are online or in the room. Digital, interactive Value Propositions turn one-way monologues into two-way, interactive collaboration.

Our existing account management needs to rise above talking about activity. Customer Success is Customer Value delivered.